Susquehanna Rates Steve Madden as ‘Positive’

Steve Madden (SHOO) has a market cap of $2.2 billion. It rose by 2.6% to close at $36.20 per share on August 12, 2016.

Aug. 16 2016, Updated 9:07 a.m. ET

Price movement

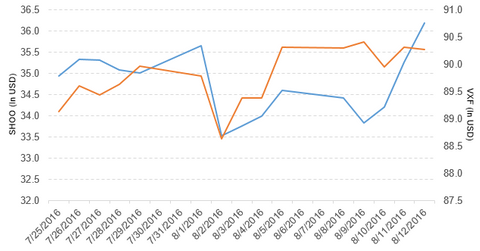

Steve Madden (SHOO) has a market cap of $2.2 billion. It rose by 2.6% to close at $36.20 per share on August 12, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 4.6%, -0.49%, and 19.8%, respectively, on the same day. SHOO is trading 3.7% above its 20-day moving average, 4.5% above its 50-day moving average, and 7.4% above its 200-day moving average.

Related ETF and peers

The Vanguard Extended Market ETF (VXF) invests 0.05% of its holdings in Steve Madden. The ETF tracks a market-cap-weighted version of the S&P Total Market Index, excluding all S&P 500 stocks. The YTD price movement of VXF was 8.4% on August 12.

The market caps of Steve Madden’s competitors are as follows:

Steve Madden’s rating

Susquehanna has initiated the coverage of Steve Madden with a “positive” rating and set the stock price target at $42 per share.

Performance of Steve Madden in 2Q16

Steve Madden reported 2Q16 net sales of $325.4 million, a rise of 0.56% over the net sales of $323.6 million in 2Q15. The company’s gross profit margin rose by 3.6% and its income from operations fell by 2.4% between 2Q15 and 2Q16.

Its net income and EPS (earnings per share) rose to $24.7 million and $0.42, respectively, in 2Q16, compared with $24.5 million and $0.40, respectively, in 2Q15. SHOO’s cash and cash equivalents and inventories rose by 5.4% and 14.0%, respectively, between 4Q15 and 2Q16. Its debt-to-equity ratio rose to 0.36x in 2Q16, compared with a debt-to-equity ratio of 0.35x in 4Q15.

Projections

Steve Madden (SHOO) has made the following projections for fiscal 2016:

- net sales growth in the range of 0%–1%

- EPS in the range of $1.93–$2.03

Next, we’ll discuss Skechers USA.