What Does the Break-Even Rate Suggest?

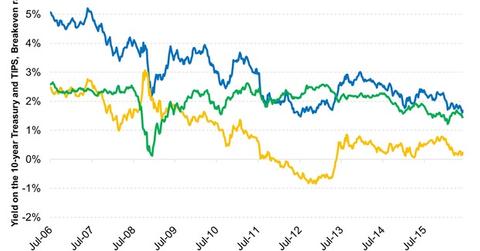

The break-even rate is the difference between the yields of ten-year Treasuries (IEF) (TLH) and ten-year TIPS (VTIP).

July 25 2016, Published 10:28 a.m. ET

Characteristics of Inflation-Linked Bond Coupons and Yields

Yield on inflation-linked bonds is calculated on a real rate of return and known as “real yield,” which does not include the performance of the inflation index. At times, the real yield on inflation-linked bonds can be negative. This is due to their relationship with comparable Treasury bonds. To understand this relationship, one has to understand the breakeven rate.

The breakeven rate is the difference between the yield on a conventional Treasury bond and the real yield on an inflation-linked bond of similar maturity and credit quality. The breakeven rate reflects the market’s expectation for inflation, and helps to determine which asset will outperform the other. If the inflation rate averages more than the breakeven rate, the inflation-linked bond will outperform the conventional Treasury bond. Conversely, if inflation performs lower than the breakeven rate, the conventional Treasury bond will outperform the inflation-linked bond. Theoretically, if the inflation rate stays at the breakeven rate, neither security will outperform the other.

The real yield on an inflation-linked bond will go below zero if Treasury bonds are trading at yields below the inflation rate. Inflation adjustments to the principal value offset negative yields. The total expected return on an inflation-linked bond is the real yield plus the expected principal adjustments.

What does the break-even rate suggest? Market Realist’s View

The graph above shows the yields on ten-year Treasuries (IEF) (TLH) and ten-year TIPS (Treasury Inflation-Protected Securities) (VTIP). It also shows the break-even rate, which is the difference between the yields of the two. Basically, what separates the two is that TIPS are inflation-protected. So the difference in the two reflects inflation expectations of the Market.

In 2009, during the Great Recession, TIPS underperformed. Ten-year inflation expectations dipped to ~0% as investors worried that inflation could stay low in the long term. Currently, long-term inflation expectations remain low at 1.5% due to low global (ACWX) growth expectations. If that turns out to be the case, TIPS could underperform.