Reading Miners’ Correlation Trends

Mining stocks Before investors park their money in mining stocks, it’s crucial for them to compare miners’ performance with gold. In this part of the series, we’ll analyze the correlations of AngloGold Ashanti (AU), Hecla Mining (HL), Kinross Gold (KGC), and Eldorado Gold (EGO) with gold. The VanEck Vectors Junior Gold Miners ETF (GDXJ) and the […]

Sept. 8 2017, Published 4:01 p.m. ET

Mining stocks

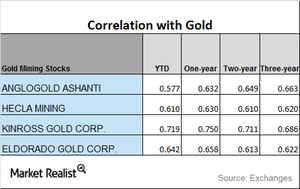

Before investors park their money in mining stocks, it’s crucial for them to compare miners’ performance with gold. In this part of the series, we’ll analyze the correlations of AngloGold Ashanti (AU), Hecla Mining (HL), Kinross Gold (KGC), and Eldorado Gold (EGO) with gold.

The VanEck Vectors Junior Gold Miners ETF (GDXJ) and the iShares MSCI Global Gold Miners ETF (RING) are also closely correlated with gold. GDXJ and RING have risen 7.9% and 5.8%, respectively, on a trailing-five-day basis.

Correlation trends

Of the above miners, Kinross Gold has the highest correlation with gold, while AngloGold has the lowest correlation. Kinross Gold’s correlation has been trending upward, while the other three miners have seen a mix of uptrends and downtrends in their correlation with gold.

A mining stock’s rise in correlation suggests that price variations in gold could see it move in the same direction, and lower correlation suggests that it may diverge from what’s happening with the price of the metal.

Kinross’s correlation with gold has increased from a three-year correlation of ~0.69 and a one-year correlation of ~0.75. A correlation of ~0.75 means that its price has moved alongside gold ~75.0% of the time.