The Re-Emergence of Seasonal Gold Demand Trends

With selling pressure removed, normal gold demand trends may re-emerge Historically, there is a seasonal pattern to gold prices dependent on physical demand trends. Often, there is weakness in the summer when jewelry demand, primarily from China and India, is low and trading volumes decline. Seasonal strength often occurs from August to January, beginning with […]

Oct. 8 2020, Updated 1:34 p.m. ET

With selling pressure removed, normal gold demand trends may re-emerge

Historically, there is a seasonal pattern to gold prices dependent on physical demand trends. Often, there is weakness in the summer when jewelry demand, primarily from China and India, is low and trading volumes decline.

Seasonal strength often occurs from August to January, beginning with the Indian festival season and ending with Chinese New Year. Gold demand from China has been weak and from India has been even weaker. The Indian Finance Ministry reported 218 tons of imports in the first half, a 52% decline from the first half of 2015. This is to be expected as Indian and Asian demand overall, usually declines when the price is rising, as gold investors in these regions tend to wait for price weakness to restock. Changes to Indian demand may be coming though.

The Indian monsoons have been good this year which boosts crop output and the ability of rural farmers to potentially increase their gold savings, and the Diwali festival begins October 30.

In addition to the macro drivers, seasonal strength may provide a boost to gold prices as the New Year approaches. This summer, any seasonal price weakness has been offset by gold’s appeal following the extraordinary Brexit rally which has delayed the return of the normal gold market pattern. This pattern has been absent for several years due to the relentless selling pressure during the gold bear market.

However, shorting gold has been a very risky bet in 2016. Now that the gold bears are on the run, perhaps seasonality will again influence the market.

Market Realist: Seasonal factors working in favor of gold

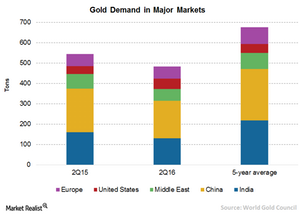

Gold (GDX) demand is highly seasonal in nature. Gold’s (GDXJ) key demand drivers include the Chinese New Year and the festival and wedding season in India. China and India are the world’s biggest gold consumers, with a share of 65.3%, or 314.7 tons, of the total consumption in the second quarter.

While investments account for the largest component of gold (IAU) demand—with a share of 42.7% of the total in the second quarter—jewelry demand plunged to second place at 42.3%.

In the second quarter, China’s jewelry purchases declined by 14% to 183.7 tons, while India witnessed an 18% fall to 131 tons. Due to higher prices and weak rural incomes, India’s gold imports declined by 48% to $3.9 billion in the second quarter YoY (year-over-year)—the lowest since the fourth quarter of 2013.

Jewelry demand to pick up

The World Gold Council expects global jewelry demand to pick up in the second half of 2016 due to the upcoming Indian festival and wedding season and to expectations of a strong monsoon, which should boost farming income in rural areas. In India (SCIF), farmers have accounted for close to 65% of the total gold demand in the country. Consumer confidence in India’s hinterland is picking up, as well, after a spell of very good monsoon. With property market stagnating, rural folks are likely to turn toward gold during the approaching festive season.

Chinese demand is also expected to remain healthy due to the upcoming New Year related festivities.

Although gold’s (GLD) recent rise has been aided by tailwinds like slower global growth, the UK’s Brexit vote to exit the European Union, and lower returns from bonds and equities, movement in the second half will likely be driven by favorable seasonal factors.

Important disclosures

1 NYSE Arca Gold Miners Index (GDMNTR) is a modified market capitalization-weighted index comprised of publicly traded companies involved primarily in the mining for gold.

2 MVIS Global Junior Gold Miners Index (MVGDXJTR) is a rules-based, modified market capitalization-weighted, float-adjusted index comprised of a global universe of publicly traded small- and medium-capitalization companies that generate at least 50% of their revenues from gold or silver mining, hold real property that has the potential to produce at least 50% of the company’s revenue from gold or silver mining when developed, or primarily invest in gold or silver.

3 S&P 500® Index (S&P 500) consists of 500 widely held common stocks, covering four broad sectors (industrials, utilities, financial, and transportation).

4 A black swan event is an event or occurrence that deviates beyond what is normally expected of a situation and is extremely difficult to predict. These events are typically random and are unexpected.