Marathon Petroleum’s Stock Performance: Up by 28% since June 30

Since the end of June, Marathon Petroleum’s (MPC) stock has risen by 28%. MPC has crossed over its 50-day and its 200-day moving averages during this period.

Aug. 22 2016, Published 12:18 p.m. ET

Refining stocks performance through February 2016

In 2015 until November 30, stocks of refining companies like Marathon Petroleum (MPC) witnessed an upward spiral. This occurred on the back of better refining margins and earnings.

However, refining stocks started falling in December 2015, with the news of the abolition of the crude oil export ban in the US. This raised fears of a fall in the refining margin of refineries in the US. Plus, the swelling inventory levels of refined products, coupled with narrowing cracks, put further pressure on refining stocks.

MPC’s roller coaster ride since February 2016

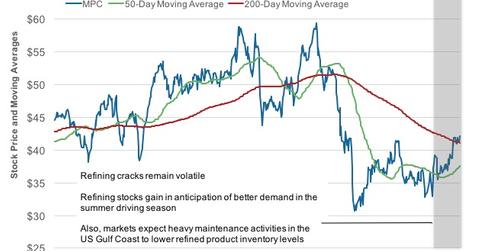

Marathon Petroleum (MPC) stood below its 50-day and 200-day moving averages in January 2016. The downward journey of refining stocks paused in February 2016. Since then, refining stocks have experienced a roller coaster performance on the back of a volatile refining environment.

In February 2016, Marathon Petroleum’s regional refining crack indicators started strengthening. Amid stock price volatility, MPC rose by 33% from February 8 to April 26, 2016. MPC’s stock crossed over its 50-day moving average during this period.

This was followed by a volatile crack environment phase. From the end of April until the end of June, Marathon Petroleum lost 20% of its value. MPC also broke below its 50-day moving average in this period.

However, since the end of June, refining stocks rose in anticipation of a better refining margin environment. This was due to a higher estimated demand due to the summer season and heavy maintenance activities in the US Gulf Coast. Since the end of June, Marathon Petroleum’s stock has risen by 28%. MPC has crossed over its 50-day and its 200-day moving averages during this period.

During the same period, Tesoro (TSO) rose by 7%, Valero Energy (VLO) rose by 7%, and Phillips 66 (PSX) rose by 1%. The PowerShares Dynamic Large Cap Value Portfolio ETF (PWV) has ~4% exposure to energy sector stocks.

Currently, Marathon Petroleum (MPC) is trading above its 50-day and 200-day moving averages.