Why BAC Is Better Positioned to Gain from a Rate Hike Than JPM

Bank of America (BAC) is better positioned to gain from an interest rate hike than JPMorgan Chase (JPM). It’s more sensitive to interest rate changes.

Aug. 10 2016, Published 9:44 a.m. ET

Bank of America is better positioned to gain from higher interest rates

Bank of America (BAC) is better positioned to gain from an interest rate hike than JPMorgan Chase (JPM). This is because it’s more sensitive to interest rate changes than JPMorgan due to its large loan portfolio and its large proportion of interest rate–related income.

A Citigroup (C) report mentions, “For Investors With More Constructive Outlook On Rates and Economy, We Believe Bank of America [BAC] Is Better Play — The risk of downgrading JPMorgan here is that we continue to see good news on the rate front, but we prefer Bank of America since we view it as better positioned for higher rates and more room for multiple revaluation (Bank of America currently trades at highest implied cost of equity in our group of 11.8% vs JPMorgan at 10.5%).”

A 100-basis-point change in interest rates would lead to a $6 billion rise in BAC’s net interest income, and net interest income comprises ~50% of the company’s total income, representing one of the largest sources of BAC’s revenue.

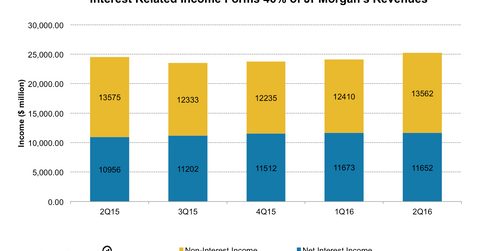

For JPMorgan, net interest income makes up 46% of its total income. A 100-basis-point change in interest rates would a lead to a $3 billion rise in JPMorgan’s net interest income.

Notably, Bank of America and JPMorgan have some of the largest loan portfolios in the financial sector (XLF). In 2Q16, JPMorgan had a loan portfolio worth $872 billion. By comparison, Bank of America had a loan portfolio worth $903 billion, while Wells Fargo (WFC) and Citigroup had loans of $951 billion and $592 billion, respectively.

Bank of America and JPMorgan are not alone in their struggles to boost earnings without lifts from higher rates. Their falls in profits despite loan growth are similar to those of their peers, including Wells Fargo (WFC) and Citigroup.

Last month, the United Kingdom voted to exit the European Union. This was followed by volatility in financial markets and has led to the IMF’s (International Monetary Fund) cutting growth forecasts for the global economy.

These factors have led to a deterioration in the outlook for future interest rate hikes. Therefore, interest rates will likely be lower for longer, meaning squeezed net interest margins for banks.

Higher interest rates lead to higher net interest income for banks, thereby resulting in higher profitability margins. However, the Fed has retreated from its expected interest rate hikes, leading to further margin pressures.