Will Boeing’s Dividend Payout Increase in the Rest of 2016?

Looking at Boeing’s dividends, we see that it has been a consistent dividend payer for more than two decades. For 2Q16, it paid a total of $691 million in dividends.

Aug. 2 2016, Updated 11:05 a.m. ET

Boeing’s dividends

Boeing has been a consistent dividend payer for more than two decades. For the second quarter of 2016, it paid a total of $691 million in dividends. That’s ~27% of its free cash flow for 2015.

Boeing’s high yield

After its 4Q15 earnings, Boeing stock took a 10% hit, which resulted in dividend yields rising to 3.7%.

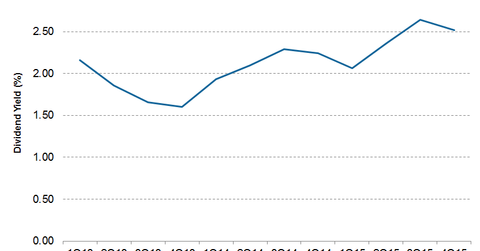

With the stock recovering to $133 after its 2Q16 earnings, the dividend yield has currently fallen to 3.3%. This is still higher than the industrial average dividend yield of 2.3%.

Boeing has a trailing 12-month (or TTM) yield of 2.0%. This is lower than Airbus with a TTM yield of 4.9%. Lockheed Martin (LMT) has a dividend yield of 2.5%, United Technologies’ (UTX) is 2.4%, and General Dynamics’ (GD) is 2.0%.

Cash dividend coverage ratio

The cash dividend coverage ratio is calculated as income before extraordinary items minus minority and preferred dividends over dividends paid. It measures the ability of the company to pay dividends.

Given Boeing’s reported loss in 2Q16, its cash dividend ratio was negative at the end of 2Q16. This theoretically means that Boeing won’t be able to sustain dividend payouts at the current rate for a long time.

However, we should remember that Boeing’s losses are a result of the charges that are expected to stop going forward.

Boeing’s outlook

Boeing’s dividend payout has historically increased once every four quarters. The company has already announced a 20% increase in quarterly dividends for 2016. This amounts to a dividend per share of $1.09. It’s expected to stay at that level for the rest of 2016.

Boeing forms 4.5% of the PowerShares Buyback Achievers ETF (PKW).