Why Freeport-McMoRan Missed Q2 Revenue Estimates

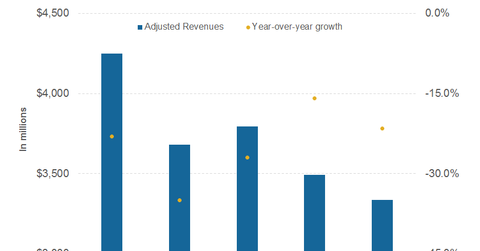

Freeport-McMoRan (FCX) posted revenues of $3.3 billion in 2Q16. In contrast, Freeport posted revenues of nearly ~$4.2 billion in 2Q15.

Nov. 20 2020, Updated 12:00 p.m. ET

2Q16 revenues

Freeport-McMoRan (FCX) posted revenues of $3.3 billion in 2Q16. In contrast, Freeport posted revenues of nearly ~$4.2 billion in 2Q15 and ~$3.5 billion in 1Q16. Freeport’s 2Q16 revenues fell year-over-year and on a sequential quarterly basis. Freeport’s 2Q16 revenues fell well short of analysts’ expectations of $3.7 billion. Plus, even the consensus earnings estimates looked somewhat conservative, as we noted in our pre-earnings analysis. Let’s see why Freeport missed 2Q16 consensus revenues.

Revenue miss

The revenues for commodity producers, including BHP Billiton (BHP), Rio Tinto (RIO), and Teck Resources (TCK), are intertwined with commodity prices (GCC) and shipments. For 2Q16, Freeport gave guidance of ~1.1 billion pounds of copper, 195,000 ounces of gold, 19 million pounds of molybdenum, and 13.5 MMboe (or million barrels of oil equivalent).

However, Freeport’s actual 2Q16 shipments were lower than its guidance. While the copper volumes were more or less in line with Freeport’s guidance of 1.1 billion pounds, gold sales at 156,000 ounces fell well short of Freeport’s guidance by 39,000 ounces. Energy sales at 13.1 MMboe were also 0.4 MMboe below Freeport’s guidance. Lower gold volumes were due to labor issues at Freeport’s Grasberg mine.

Average selling prices

Meanwhile, Freeport’s average selling improved on a sequential quarterly basis. In 2Q16, Freeport reported average realized prices of $2.18 per pound for copper, $1,292 per ounce for gold, and $41.1 per barrel for oil. To put this in context, consider that Freeport had reported average realized prices of $2.17 per pound for copper, $1,227 per ounce for gold, and $29.06 per barrel for oil in 1Q16.

Along with revenues, you should also look at Freeport-McMoRan’s profitability. In the next part of the series, we’ll look at the company’s 2Q16 profits.