Has WFT’s Correlation with Crude Oil Fallen since 1Q16?

In this article, we’ll analyze the correlation between Weatherford International’s (WFT) stock price and West Texas Intermediate (or WTI) crude oil’s price.

July 13 2016, Updated 11:07 a.m. ET

Correlation coefficient

In this article, we’ll analyze the correlation between Weatherford International’s (WFT) stock price and West Texas Intermediate (or WTI) crude oil’s price. The correlation coefficient between WFT’s and crude oil’s prices measures the statistical relationship between the two variables.

A correlation coefficient value of 0 to 1 shows a positive correlation, 0 shows no correlation, and -1 to 0 shows an inverse correlation.

How related are Weatherford International’s and crude oil’s prices?

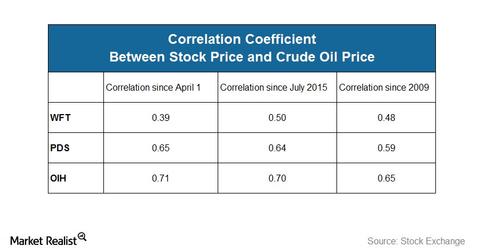

The correlation coefficient between Weatherford International’s stock price and crude oil’s price from July 2015 to the present is 0.50. This indicates a relatively strong positive relationship between crude oil prices and Weatherford International’s stock.

Correlation between WFT’s stock and crude oil

As noted in the table above, WFT’s correlation with crude oil’s price fell from the end of 1Q16 to July 8, 2016, compared to the past year. The VanEck Vectors Oil Services ETF’s (OIH) correlation with crude oil has risen since April 1 compared to its correlation coefficient since July 2015.

Precision Drilling’s (PDS) correlation coefficient since April 1 is higher than WFT’s. WFT makes up 0.02% of the iShares MSCI World ETF (URTH).

Next, we’ll discuss Wall Street analysts’ recommendations for WFT.