iShares MSCI World

Latest iShares MSCI World News and Updates

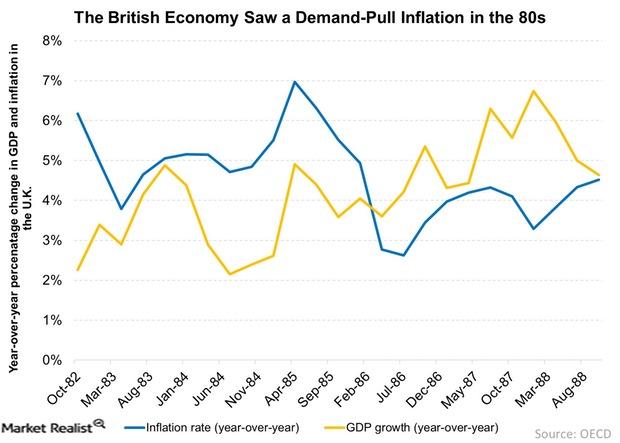

What Is Demand-Pull and Cost-Push Inflation?

Both Russia (RSX) and Brazil (EWZ) are experiencing cost-push inflation. Both economies are highly dependent on commodities.

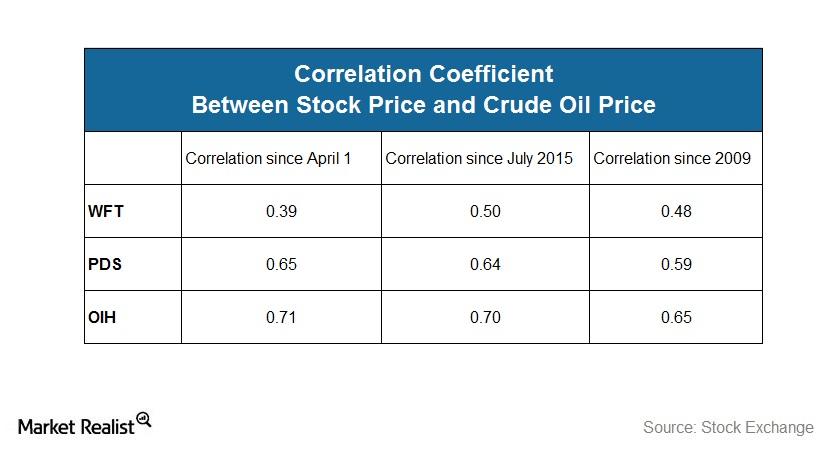

Has WFT’s Correlation with Crude Oil Fallen since 1Q16?

In this article, we’ll analyze the correlation between Weatherford International’s (WFT) stock price and West Texas Intermediate (or WTI) crude oil’s price.