How Did PepsiCo’s 2Q16 Earnings Turn Out?

PepsiCo rose by 1.5% to close at $107.49 per share on July 7. Its weekly, monthly, and YTD price movements were 4.2%, 4.9%, and 9.2% that day.

Nov. 20 2020, Updated 4:32 p.m. ET

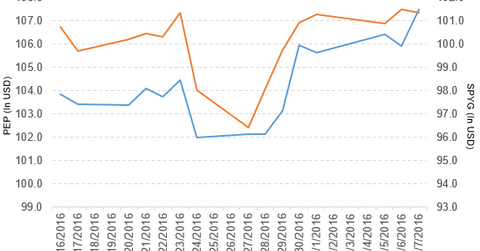

Price movement of PepsiCo

PepsiCo (PEP) has a market cap of $155.7 billion. It rose by 1.5% to close at $107.49 per share on July 7, 2016. The stock’s weekly, monthly, and YTD (year-to-date) price movements were 4.2%, 4.9%, and 9.2%, respectively, on the same day. This means that PEP was trading 3.6% above its 20-day moving average, 4.5% above its 50-day moving average, and 8.4% above its 200-day moving average.

Related ETF and peers

The SPDR S&P 500 Growth ETF (SPYG) invests 0.92% of its holdings in PepsiCo. The ETF tracks an index of primarily large-cap growth stocks. The index selects companies from the S&P 500 Index based on three growth factors. The YTD price movement of SPYG was 1.6% on July 7.

The market caps of PepsiCo’s competitors are as follows:

Performance of PepsiCo in fiscal 2Q16

PepsiCo reported fiscal 2Q16 net revenues of $15.4 billion, a fall of 3.1% compared to net revenues of $15.9 billion in fiscal 2Q15. Revenue from Frito-Lay North America, quaker foods North America, and North America beverages rose by 3.2%, 2.7%, and 0.63%, respectively.

Revenues from Latin America, Europe Sub-Saharan Africa, and Asia, the Middle East, and North Africa fell by 22.8%, 5.4%, and 1.5%, respectively, in fiscal 2Q16 over fiscal 2Q15. The company’s gross profit margin and operating profit rose by 2.0% and 2.2%, respectively, in fiscal 2Q16 over fiscal 2Q15.

Net income and EPS

Its net income and EPS (earnings per share) rose to $2.01 billion and $1.38, respectively, in fiscal 2Q16 compared to $1.98 billion and $1.33, respectively, in fiscal 2Q15.

PEP’s cash and cash equivalents and inventories rose by 6.0% and 28.2%, respectively, in fiscal 2Q16 over fiscal 4Q15. Its current ratio and debt-to-equity ratio rose to 1.4x and 4.9x, respectively, in fiscal 2Q16, as compared to 1.3x and 4.8x, respectively, in fiscal 4Q15.

Projections

The company has made the following projections for fiscal 2016:

- core EPS of $4.71

- organic revenue growth of ~4%, which excludes the impact of the 53rd week and structural changes, including the deconsolidation of its Venezuelan operations

- productivity savings of ~$1 billion

- cash flow from operating activities over $10 billion

- free cash flow of more than $7 billion, which excludes certain items

- net capital spending of ~$3 billion

- a return of ~$7 billion to its shareholders through the dividend of ~$4 billion and share repurchases of ~$3 billion.

For an ongoing analysis of this sector, please visit Market Realist’s Consumer Discretionary page.