How Are Inflation, Interest Rates, and Foreign Exchange Related?

A low rate of inflation doesn’t guarantee a favorable exchange rate. But a high inflation rate is likely to have a negative effect on a currency’s value.

July 25 2016, Published 10:23 a.m. ET

Inflation, Interest Rates and FX

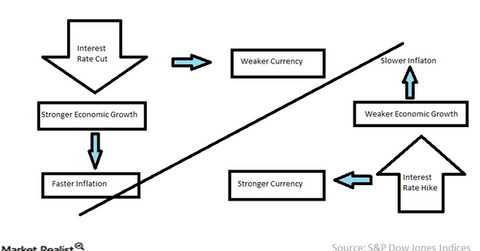

The rate of inflation influences the direction of interest rates and, conversely, interest rates influence the direction of inflation. If inflation is high, interest rates will typically be raised by the U.S. Federal Reserve to slow economic growth. If inflation is low, economic growth is generally low, and a decrease in rates is enacted in order to lower the cost of borrowing and to spur economic growth. More borrowing power can lead to spending, a stronger economy and, ultimately, inflation. The U.S. Federal Reserve has the task of finding the right balance of tweaking interest rates to manage growth and keeping unemployment low and wages high. The Federal Reserve also has to avoid promoting too much growth, which could lead to high inflation. The Fed generally tries to keep inflation within the 2%-3% range.

When interest rates are increased to tame inflation, foreign capital is usually attracted to the higher rates compared with other countries, and there is more investment in the higher rate environment. This causes the exchange rate to rise. However, if inflation is high (diminishing the purchasing power of that currency), the rise of the currency could be limited. If rates go lower, the opposite is generally true and the currency is likely to suffer.

How inflation and interest rates affect foreign exchange rates Market Realist’s View

A low rate of inflation doesn’t guarantee a favorable exchange rate. But a high inflation rate is likely to have a negative effect on a currency’s value.

Central banks usually cut rates when inflation and GDP growth are low, as we’ve already mentioned. They do this in order to boost spending and corporate investments. It usually leads to a stronger currency since a robust economy attracts funds from other nations.

However, currency movements are driven by many factors. Inflation and interest rates are two key factors, but the following also come into play: fiscal policies, monetary policies, political risks, current account deficits, public debts, market speculation, and more.

After the QE (quantitative easing) program ended in October 2014, which led the US economy back to a growth path, the US dollar (UUP) started appreciating. This is because other developed markets (VEA) weren’t experiencing sluggish growth.

Central banks in developed markets, especially the European Central Bank and the Bank of Japan, initiated their own versions of QE. This caused diverging monetary policies, which was the main reason for the appreciation of the dollar. As the Fed hikes rates further, the dollar is expected to strengthen.