Why Did CSX’s Carloads Slump in the Week Ending July 16?

CSX (CSX) is a major operator in the Eastern US that competes with Norfolk Southern (NSC).

Nov. 20 2020, Updated 5:20 p.m. ET

CSX’s carloads

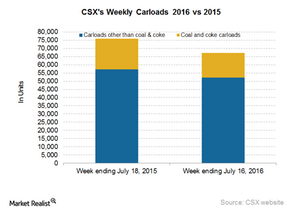

CSX (CSX) is a major operator in the Eastern US that competes with Norfolk Southern (NSC). In the week ended July 16, 2016, CSX’s carloads excluding coal and coke fell by 8.9%, in sharp contrast with the 1% rise reported by NSC in the same category. Overall, CSX hauled 67,000 plus carloads in the reported week of 2016 against ~76,000 carloads in the week ended July 18 last year.

Why coal carloads matter

CSX’s coal plus coke railcars went down 19.8% in the week ended July 16, 2016, almost in line with the fall recorded by Norfolk Southern in the same category. You should note that coal accounted for 16% of CSX’s total volumes and 19% of its total revenues last fiscal year.

According to the US Energy Information Administration, the Appalachia region’s coal output is expected to fall by 9% in 2016. However, the agency expects total coal production to increase by 2% and stabilize in 2017. CSX mainly connects coal mining operations in the Appalachian mountain region.

The Eastern railroads have cited electricity generation plants’ shift from coal to natural gas (UNG) as one of the reasons for the fall in utility coal transportation. The coal tsunami has affected major coal producers in the US like Alliance Resource Partners (ARLP), CONSOL Energy (CNX), and Peabody Energy (BTU). Due to the sharp decline in coal prices, Peabody filed for Chapter 11 bankruptcy protection in the US on April 13.

Commodity groups

The commodity groups that posted significant gains were lumber and wood products, waste and non-ferrous scrap, and motor vehicles and parts in the week ended July 16, 2016. The falling commodity groups were petroleum and petroleum products, farm products (excluding grain), metallic ores, and non-metallic minerals.

You can compare this week’s rail data with data from the previous week in How Did North American Rail Traffic Fare in the Week Ending July 9? For more information on major US railroad stocks, visit Market Realist’s railroads page.

We’ll go through CSX’s intermodal traffic in the next article.