Flowers Foods Made Changes in Its Management

Flowers Foods fell by 1.8% to close at $18.55 per share on July 7. The stock’s weekly, monthly, and YTD price movements were 0.32%, 0.32%, and -12.2%.

July 8 2016, Published 5:02 p.m. ET

Price movement

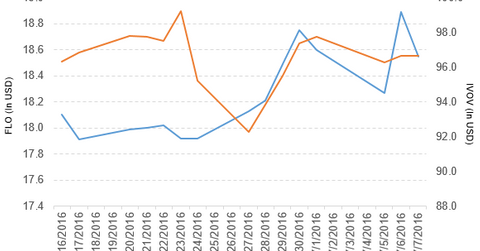

Flowers Foods (FLO) has a market cap of $3.9 billion. It fell by 1.8% to close at $18.55 per share on July 7, 2016. The stock’s weekly, monthly, and YTD (year-to-date) price movements were 0.32%, 0.32%, and -12.2%, respectively, on the same day. This means that FLO was trading 1.6% above its 20-day moving average, 0.26% below its 50-day moving average, and 9.5% below its 200-day moving average.

Related ETFs and peers

The Vanguard S&P Mid-Cap 400 Value ETF (IVOV) invests 0.70% of its holdings in Flowers Foods. The ETF tracks an index of primarily mid-cap US stocks. The index uses three factors to select value stocks from the 400 stocks chosen by the S&P Committee. The YTD price movement of IVOV was 9.3% on July 7.

The SPDR S&P 400 Mid-Cap Value ETF (MDYV) invests 0.60% of its holdings in Flowers Foods. The ETF tracks a market-cap-weighted index of US stocks. The index uses three factors to select value stocks from the 400 stocks chosen by the S&P Committee.

The market caps of Flowers Foods’ competitors are as follows:

Flowers Foods’ promotions

Mary Krier has been promoted to Flowers Foods’ Senior Vice President of Communications and Corporate Rresponsibility. Krier will be responsible for the company’s communications, consumer relations, and strategic communications counsel at corporate and subsidiary levels.

Chad Johnson has been promoted to Flowers Foods’ Vice President of Distributor Communications. Johnson will be responsible for independent distributor communications as well as communications support for distributor relations and sales staff.

Flowers Foods’ 1Q16 report

For 1Q16, Flowers Foods (FLO) reported sales of $1.2 billion, a rise of 5.1% compared to sales of $1.1 billion in 1Q15. Sales from its direct store delivery and warehouse delivery rose by 3.4% and 14.1%, respectively, in 1Q16 over 1Q15.

FLO’s net income and EPS (earnings per share) fell to $59.4 million and $0.28, respectively, in 1Q16, as compared to $61.4 million and $0.29, respectively, in 1Q15. It reported EBITDA (earnings before interest, tax, depreciation, and amortization) of $138.6 million in 1Q16, a rise of 1.6% over 1Q15.

Flowers Foods reported cash and cash equivalents and long-term debt and capital leases of $11.5 million and $1.1 billion, respectively, in 1Q16. During 1Q16, FLO made share repurchases worth $126.3 million.

Projections

Flowers Foods (FLO) has made the following projections for 2016:

- sales in the range of $4.0 billion–$4.1 billion

- EPS in the range of $1.00–$1.06, including ~$0.02 of accretion from an accelerated stock repurchase

In the next part, we’ll look at WABCO Holdings.