Understanding Roper Technologies’ Business Transformation

Roper Technologies’ Industrial Technology segment’s revenue stood at 21% of its sales in 2015. This segment’s revenue was 41% of its sales in 2014.

July 5 2016, Published 4:53 p.m. ET

Has Roper Technologies’ transformation toward a diversified technology company been rewarding?

Historically, Roper Technologies (ROP) has been more of an industrial company, manufacturing pump and flow measurement equipment. Gradually, ROP has transformed from an industrial company to a technology and software services company. Its Industrial Technology segment’s revenue stood at 21% of its sales in 2015. This segment’s revenue was 41% of its sales in 2014.

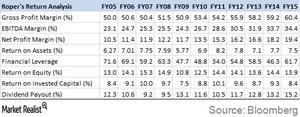

Let’s analyze Roper Technologies’ key ratios to get a better understanding of whether its transformation has been rewarding.

Roper Technologies’ stock return

From June 10, 2015, to June 10, 2016, ROP fell by 2.1% while the SPDR S&P 500 ETF (SPY) rose marginally by 0.3%. On a YTD (year-to-date) basis, ROP has fallen by ~7.6% compared to SPY, which has risen by 4.8% during the same period.

Other diversified large industrial players General Electric (GE), 3M Company (MMM), and Honeywell Industries (HON) saw stock price rises of 9.8%, 8.9%, and 11.9%, respectively, from June 10, 2015, to June 10, 2016.

Key facts about Roper Technologies

- ROP’s growth strategy includes acquisitions. It acquires companies that generate excess free cash flow for future capital deployment.

- The company’s focus is to have a leadership position in the niche markets in which it operates. Because of Roper’s leadership position and bargaining power, it has a gross margin of 61% and an EBITDA (earnings before interest, tax, depreciation, and amortization) margin of 34%.

- Roper has an asset-light business model. ROP’s capital expenditure-to-sales ratio is ~1% with a low working capital requirement. This means that its business can be scaled up easily without huge costs or massive time setting up infrastructure. Growth in such businesses is generally linear.

- The company’s 50%+ revenue is recurring, with 70% of EBITDA coming from its Medical and RF Technology segments.

In this way, we can conclude that Roper’s transformation has been for the better. Let’s read on to get a better understanding of the company’s business and background.