Roper Industries Inc

Latest Roper Industries Inc News and Updates

How Has Roper Technologies’ Stock Fared ahead of Its 2Q16 Earnings?

Roper Technologies’ stock has declined since July 2015, after touching a high of $195.93 per share on November 30, 2015.

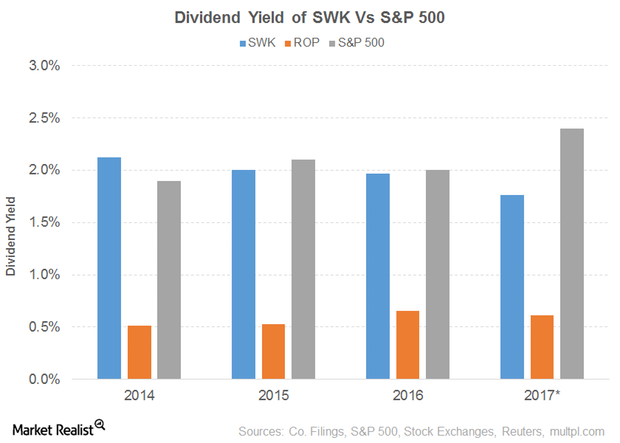

Dividend Yield of Stanley Black & Decker

Stanley Black & Decker’s (SWK) PE ratio of 21.1x is pitted against a sector average of 29.3x. The dividend yield of 1.8% is pitted against a sector average of 1.6%.

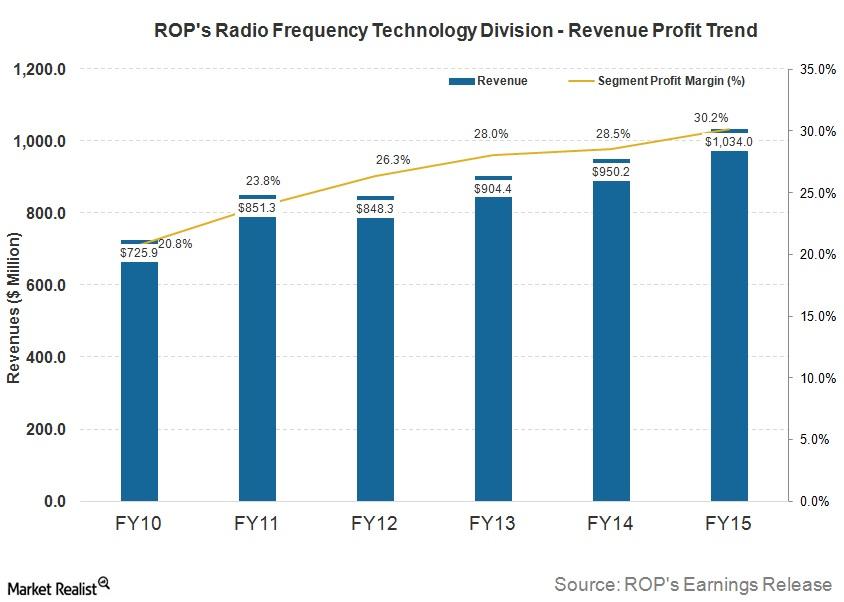

ROP’s Second-Largest Segment: Radio Frequency Technology

In 2015, ROP’s Radio Frequency Technology segment contributed ~28.9% to its total consolidated revenue and ~30.4% to its consolidated operating profit

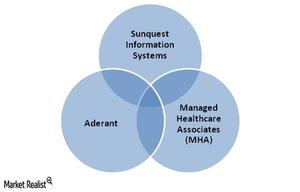

Roper Technologies: Recent Acquisitions That Count

Since its inception, Roper Technologies (ROP) has followed an acquisition-based growth strategy. The company has acquired over 50 companies since 1981.

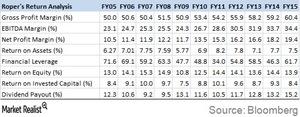

Understanding Roper Technologies’ Business Transformation

Roper Technologies’ Industrial Technology segment’s revenue stood at 21% of its sales in 2015. This segment’s revenue was 41% of its sales in 2014.