How Has the Equity Short Bias Hedge Fund Strategy Worked in 2016?

The equity short bias strategy has largely outperformed all other hedge fund strategies so far in 2016. The Barclay Equity Short Bias Index returned 9.0% in 1Q16.

April 8 2016, Updated 12:07 p.m. ET

When shorting reaps you gains

The equity short bias strategy has largely outperformed all other hedge fund strategies so far in 2016. Under the short bias strategy, fund managers maintain net short exposure to the Market. The strategy seeks to make profits when the Market falls.

The Barclay Equity Short Bias Index returned 9.0% in the first three months of the year. From the Hedge Fund Research strategies stable, the HFRI EH: Short Bias Index has risen 11.5% YTD (year-to-date) as of April 1, and the HFRX EH: Short Bias Index has risen 12.0% YTD.

Underweight stocks have outperformed

The markets have been tricky so far this year. A Goldman Sachs gauge tracking 50 underweight stocks has risen 5.3%, while an index tracking 50 overweight stocks has shed 3.1%. According to Michael O’Rourke, chief market strategist at JonesTrading Institutional Services, the advance in the index of the least preferred stocks is partly attributable to a short-covering rally.

Funds that have worked in a bear market

The equity markets have been dominated by bears so far this year. The US small-cap equity-tracking iShares Russell 2000 ETF (IWM) has fallen 2.8%, the Nasdaq-100 Index-tracking PowerShares QQQ ETF (QQQ) has lost 2.4%, the China-tracking iShares China Large-Cap ETF (FXI) has fallen 7.9%, and the developed markets–tracking iShares MSCI EAFE (EFA) has dropped 5.8%.

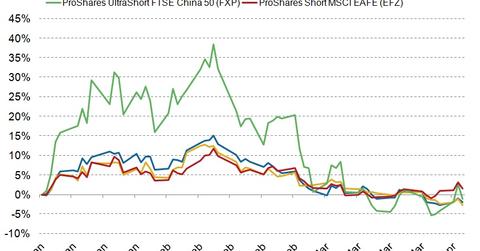

While these ETFs have lost, the inverse ETFs—that is, the ETFs that short equity in which other funds are long—posted strong gains in the first two months of the year. In the first two months, the ProShares Short Russell2000 ETF (RWM) rose 6%, the ProShares Short QQQ ETF (PSQ) gained 5.7%, the ProShares UltraShort FTSE China 50 ETF (FXP) returned 20.3%, and the ProShares Short MSCI EAFE ETF (EFZ) rose 6.8%. These ETFs are among the top funds in the inverse ETF space.

Thus, we see how inverse ETFs such as those mentioned above have gained from the bear market. As long as bears continue to dominate the markets, the equity short bias should remain the winning strategy in equity.

In the next part of this series, we’ll look at the risks of investing in the healthcare and biotech sectors.