Darden Restaurants Updates Guidance after Fiscal 4Q16 Earnings

After fiscal 4Q16 results, Darden Restaurants’ (DRI) management has revised its same-store sales growth guidance for fiscal 2017 to the range of 1%–2% as compared to earlier estimates of 1%–3%.

July 6 2016, Updated 11:07 a.m. ET

Management’s guidance for fiscal 2017

After fiscal 4Q16 results, Darden Restaurants’ (DRI) management revised its same-store sales growth guidance for fiscal 2017 to the range of 1%–2% as compared to earlier estimates of 1%–3%.

Revised same-store sales growth estimates

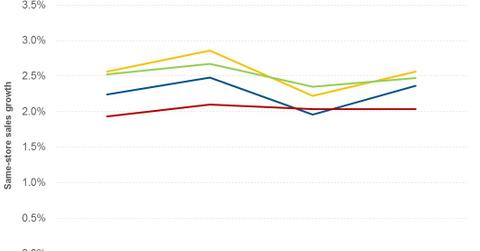

Looking at the difficult environment for casual restaurants, which saw sales fall by 2% year-over-year in fiscal 4Q16, Darden’s management has reduced its same-store sales growth guidance to the range of 1%–2% for fiscal 2017. This has led analysts to lower their same-store sales growth estimates for the next four quarters. Currently, analysts are expecting same-store sales growth for 1Q17, 2Q17, 3Q17, and 4Q17 to be 2.2%, 2.5%, 2%, and 2.4%, respectively, compared to earlier estimates of 2.6%, 2.9%, 2.2%, and 2.6%, respectively.

Revised EPS estimates

Darden’s management has set EPS guidance in the range of $3.80–$3.90, which represents growth in the range of 6.7%–9.6%. In fiscal 1Q17, the company’s management is expecting deflation in commodity prices, while for the last three quarters, management expects inflation of 1.5%–2%. This, along with lowering same-store sales growth estimates, has prompted analysts to raise their 1Q17 EPS estimates, while lowering their estimates for the last three quarters. Overall, analysts have lowered their EPS estimates for fiscal 2017 to $3.90 from their earlier estimate of $4.

Peer comparison

For fiscal 2017, analysts are expecting Darden Restaurants to post EPS growth of 9.6%. During the same period, its peers Texas Roadhouse (TXRH), Bloomin’ Brands (BLMN), and Brinker International (EAT) are expected to post EPS growth of 22.3%, 41.5%, and 7.7%, respectively.

In the next article in this series, we’ll look at the effect of fiscal 4Q16 results on Darden’s valuation multiple. Notably, Darden forms 0.22% of the iShares Russell Mid-Cap Value ETF (IWS).