Bill Gross: Credit Is the Oil That Lubes the System

Currently, we’re in a highly levered system, especially the developed world. A levered economy depends on continued credit creation for stability and growth.

Nov. 22 2019, Updated 7:12 a.m. ET

Credit is important in the economic system

Bill Gross provided an interesting analogy comparing the economic system to Monopoly—as we discussed in Part 1 and Part 2. He focused on the importance of credit in the system.

Credit is the straw that stirs the drink for levered economies

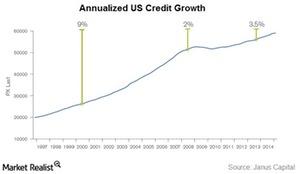

Currently, we’re in a highly levered system, especially the developed world. Gross explained that a levered economy depends on continued credit creation for stability and growth. Here, “credit” includes all credit or debt from households, businesses, government, and finance-based sources. In the US (SPXU) (SPXS) (QQQ), total credit is an astounding $62 trillion. In comparison, money supply, which refers to the M1/M2 totals, stands at ~$13 trillion.

“Credit is the oil that lubes the system, the straw that stirs the drink, and when the private system (not the central bank) fails to generate sufficient credit growth, then real economic growth stalls and even goes in reverse,” said Gross.

The highly leveraged world needs constant lubrication to keep the engine running smooth. However, credit creation in the US (IWF) (IWM) seems to be slithering. Historically, credit growth in the US has averaged 9% annually. Now, it has dwindled to less than 4% (see the above chart). With the slithering of credit creation in these economies, as debt levels are seemingly approaching alarming levels, growth could remain hard to come by.

Velocity of money is critical too

While Gross shed enough light on the importance of credit creation in highly levered economies, he also discussed the importance of the velocity of money. We’ll discuss this in the next part.