Assessing Best Buy’s debt profile

Gauging a company’s debt levels is crucial to understanding its financial health. Maintaining high debt levels in uncertain times can be damaging.

Jan. 21 2015, Updated 4:33 p.m. ET

Tough conditions

Gauging a company’s debt levels is crucial to understanding its financial health. Challenging business conditions and intense competition have impacted Best Buy (BBY) that sells consumer electronics, which are considered consumer discretionary (XLY) products. Maintaining high debt levels in uncertain times can be damaging.

Total debt-to-equity

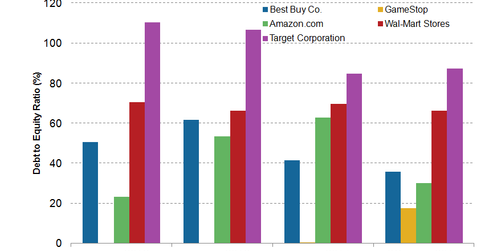

A company’s total debt-to-equity ratio indicates its financial leverage and reflects the proportion of equity and debt used to finance its assets. A lower ratio indicates lower financial risk.

Best Buy’s debt-to-equity ratio improved from 41.5% in fiscal 2014 to 35.8% in the third quarter of fiscal 2015. In that third quarter of fiscal 2015, the company’s debt-to-equity ratio was higher than GameStop (GME) 17.6% and Amazon.com (AMZN) 29.9%. Meanwhile, Best Buy’s debt-to-equity ratio is lower than those of Wal-Mart Stores (WMT) and Target (TGT).

Improved ability to service debt

The debt-to-EBITDA (earnings before interest, tax, depreciation and amortization) ratio is a key indicator of a company’s ability to pay its debt. Best Buy’s debt-to-EBITDA ratio improved from 3.22 in fiscal 2013 to 0.89 in fiscal 2014.

Credit rating

In September 2014, Fitch Ratings upgraded its long-term credit rating for Best Buy from BB- to BB, with a stable outlook. The ratings agency is optimistic that the company’s cost-reduction initiatives will fund its price-matching strategy. Fitch also expects that the company’s revenue mix shift toward high-growth and high-margin products like mobile, small accessories, and appliances will be good for end results.

In July 2014, Moody’s assigned a Baa2 long-term credit rating to Best Buy and changed its outlook from negative to stable. Standard & Poor’s maintained its BB long-term credit rating for the company, with a stable outlook. Best Buy’s credit ratings might improve further if it continues to bring down its costs and achieves higher sales at its retail stores and through its online channels.