Analyzing the Correlation between Miners and Gold in January

Most mining stocks have risen over the past one month due to the revival in gold prices.

Jan. 11 2018, Updated 7:36 a.m. ET

Miners’ correlation with gold

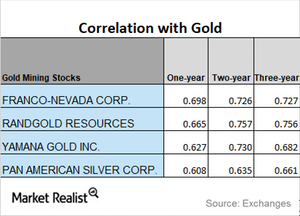

Gold is regarded as the most influential precious metal, and most miners follow its price trends. For our correlation analysis, we’ll compare mining stocks to gold. In this part of the series, we’ll look at Franco-Nevada (FNV), Randgold Resources (GOLD), Yamana Gold (AUY), and Pan American Silver (PAAS).

The past week has been beneficial for mining funds like the Alps Sprott Gold Miners (SGDM) and the iShares MSCI Global Gold Min (RING). They were up 2.2% and 2.8%, respectively, on a five-day trailing basis.

Reading the trends

Most mining stocks have risen over the past one month due to the revival in gold. It is also critical to study the relationship between miners’ price changes and gold. A correlation study of the selected miners over a span of three years can give us insight into whether miners will be affected by gold or not.

Among the four miners that we are discussing, FNV and PAAS have seen downward movement in their correlation to gold, while AUY and GOLD have seen a mixed trend in their correlation movement with gold.

The correlation of PAAS has dropped from a three-year correlation of 0.66 to a one-year correlation of 0.61. A correlation of 0.61 suggests that about 61% of the time, PAAS has moved in the same direction as gold over the past one year.