Why Did Hormel Foods Increase Its Fiscal 2016 Guidance?

Hormel Foods (HRL) increased its fiscal 2016 EPS (earnings per share) guidance to $1.60–$1.64. The earlier EPS guidance range was $1.56–$1.60.

Aug. 24 2016, Updated 10:04 a.m. ET

Outlook for fiscal 2016

Hormel Foods (HRL) increased its fiscal 2016 EPS (earnings per share) guidance to $1.60–$1.64. The earlier EPS guidance range was $1.56–$1.60. This represents a 21%–24% rise in EPS over fiscal 2015. This came after an exceptional performance in the third quarter.

Management mentioned in the fiscal 3Q16 press release that they expect a strong end to fiscal 2016. The company even projects higher sales and earnings growth in fiscal 2017. However, it didn’t provide any particular guidance.

Expectations from segments

Value-added sales are expected in the Refrigerated Foods, Jennie-O Turkey Store, and International segments. For fiscal 4Q16, products like Wholly Guacamole dips, SKIPPY peanut butter products, and Muscle Milk protein products are projected to drive sales growth. Hormel Foods expects refrigerated foods to continue growing sales and earnings in the fourth quarter. This would result from an increase in value-added products in both the retail and food service channels. The company mentioned that it estimates a 2%–3% increase in hog supply in fiscal 2017 with favorable market conditions. Expectations from the Jennie-O Turkey Store in the fourth quarter are to regain distribution and show strong sales and earnings growth.

The company expects favorable input costs to benefit the segments. The International segment is projected to show better results in the fourth quarter with growth in SKIPPY peanut butter products and SPAM lunch meat. The Justin acquisition and positive momentum in SKIPPY peanut butter and Wholly Guacamole dips are expected to drive sales growth for the Grocery Products segment. The sale of the Diamond Crystal Brands business will continue to impact the Specialty Foods segment.

To drive revenue growth, Hormel Foods announced the make-the-switch advertising campaign. It expects Jennie-O Ground Turkey products to benefit in growth and distribution. Hormel continues to invest in marketing and advertising on its Hormel Pepperoni, Applegate, Hormel Black Label bacon, Hormel Natural Choice, SPAM, and Jennie-O brands.

Hormel Foods’ effective tax rate is estimated to be ~32%–32.5% in fiscal 2016. This would include one-time discrete items from the third quarter. It also expects to have capital expenditures of ~$250 million in fiscal 2016.

Peers

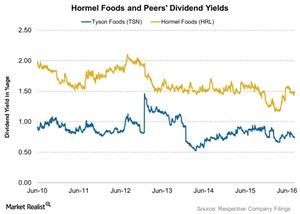

Hormel’s peers in the industry include B&G Foods (BGS), Pinnacle Foods (PF), and Cal-Maine Foods (CALM). They have seen year-to-date returns of 36%, 19%, and -5%, respectively, as of August 22. The PowerShares Dynamic Large Cap Growth Portfolio (PWB) invests 1.4% of its holdings in Hormel. The PowerShares Dynamic Food & Beverage Portfolio (PBJ) invests 2.8% of its holdings in Hormel. PBJ has returned ~6%, while the S&P 500 Index (SPY) has returned 7% so far in 2016.