Why Tata Motors’ Top and Bottom Lines Rose in Fiscal 4Q16

Tata Motors (TTM) has a market capitalization of $21.6 billion. It rose by 12.4% to close at $33.49 per share on May 31, 2016.

June 2 2016, Updated 9:07 a.m. ET

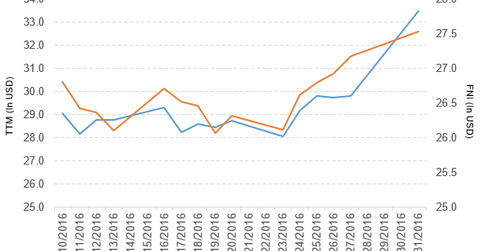

Price movement of Tata Motors

Tata Motors (TTM) has a market capitalization of $21.6 billion. It rose by 12.4% to close at $33.49 per share on May 31, 2016.

The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 19.4%, 10.2%, and 13.6%, respectively, as of the same day. This means that TTM is trading 15.2% above its 20-day moving average, 14.3% above its 50-day moving average, and 22.9% above its 200-day moving average.

Related ETF and peers

The First Trust ISE Chindia Fund (FNI) invests 3.5% of its holdings in Tata Motors. The ETF tracks an index of stocks from China and India screened by market capitalization and weighted in tiers. The YTD price movement of FNI was -2.9% as of May 31, 2016.

The market capitalizations of Tata Motors’ competitors are as follows:

Performance of Tata Motors in fiscal 4Q16 and fiscal 2016

Tata Motors reported fiscal 4Q16 total income from operations of 806.8 billion Indian rupees, a rise of 19.0% compared to total income from operations of 677.8 billion rupees in fiscal 4Q15. Revenue from Tata and other brands’ vehicles and financing and Jaguar & Land Rover automotive segments rose by 22.9% and 18.2%, respectively, in fiscal 4Q16 compared to fiscal 4Q15.

Tata Motors’ net income, EPS (earnings per share) of ordinary shares, and EPS of class A ordinary shares rose to 52.1 billion rupees, 15.23 rupees, and 15.33 rupees, respectively, in fiscal 4Q16, compared to 17.5 billion rupees, 5.26 rupees, and 5.36 rupees, respectively, in fiscal 4Q15.

Fiscal 2016 results

In fiscal 2016, Tata Motors reported total income from operations of 2.8 trillion rupees, a rise of 4.7% year-over-year. Its net income, EPS of ordinary shares, and EPS of class A ordinary shares fell to 111.1 billion rupees, 32.60 rupees, and 32.70 rupees, respectively, in fiscal 2016, compared to 140.6 billion rupees, 42.97 rupees, and 43.07 rupees, respectively, in fiscal 2015.

Tata Motors’ cash and bank balances and inventories rose by 2.4% and 14.1%, respectively, in fiscal 2016. Its current ratio rose to 1.04x, and its long-term debt-to-equity ratio fell to 0.95x in fiscal 2016, compared to 1.01x and 1.5x, respectively, in fiscal 2015.

In the next and final part of this series, we’ll discuss Toyota Motor.