Analysts’ Recommendations for Varian Medical Systems

With the spin-off of its Imaging Components business, Varian Medical Systems (VAR) is now more aligned with its core capabilities. In this series, we’ll discuss the company’s dynamics after the Varex spin-off.

Aug. 14 2017, Updated 10:38 a.m. ET

Analysts’ recommendations

Varian Medical Systems (VAR) has positioned itself as a leading cancer management company. With the spin-off of its Imaging Components business, Varex Imaging (VREX), the company is now more aligned with its core capabilities.

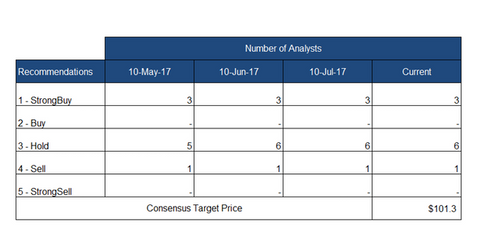

Let’s look at Wall Street analysts’ recommendations and target prices for the company over the next year. In a Reuters survey, ten brokerage companies provided recommendations on Varian stock. Approximately 30% gave “buy” ratings, while ~60% gave “hold” ratings. There was one “sell” rating.

A summary of recommendations for Varian over the next year is shown in the above chart. The stock’s consensus 12-month target price is $101.30, which represents a ~5.3% return based on its closing price of $96.20 on August 9, 2017.

Target prices

Based on analysts’ recommendations, Varian’s highest 12-month target price is $110, representing a maximum one-year return potential of 14%. The lowest 12-month target price is $75, which represents the lowest one-year return potential of -22%. In July 2017, RBC Capital Markets maintained its “hold” rating on Varian stock and raised its price target of $90. In July 2017, Jefferies provided a “buy” rating for the stock. Citigroup also has a “buy” rating on the stock.

Peers Accuray (ARAY), Intuitive Surgical (ISRG), and Boston Scientific (BSX) have average broker target prices of ~$6.25, $1,005.80, and $30.85, respectively. These figures imply returns of 48.8%, 6.6%, and 16%, respectively, over the next 12 months.

Investors keen on industry-focused exposure to Varian could consider the iShares US Medical Devices ETF (IHI), of which Varian comprises ~1.6%. In this series, we’ll discuss the company’s dynamics after the Varex spin-off.