Valeant Pharmaceuticals: An Inorganic Growth Story

Valeant Pharmaceuticals International (VRX) has grown inorganically through highly leveraged acquisitions. From 2008 to 2015, it acquired more than 100 companies.

Nov. 20 2020, Updated 5:17 p.m. ET

Valeant’s history

In 1994, ICN Pharmaceuticals, ICN Biomedicals, SPI Pharmaceuticals, and Viratek merged to form ICN Pharmaceuticals, Inc. In 2003, it changed its name to Valeant Pharmaceuticals International.

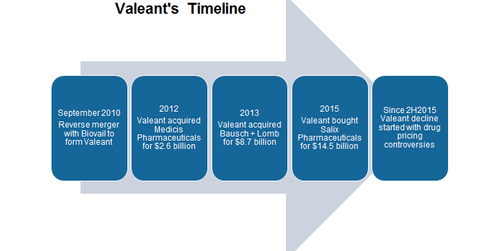

In September 2010, Biovail, a Canadian pharmaceutical company, acquired Valeant, and the combined entity retained the name Valeant Pharmaceuticals International. Valeant then shifted its headquarters from the United States to Canada.

Growth through acquisitions

Valeant Pharmaceuticals International (VRX) has grown inorganically through highly leveraged acquisitions. From 2008 to 2015, it acquired more than 100 companies. Some of its major acquisitions include the following:

- 2008: Coria Laboratories; DermaTech

- 2009: Dow Pharmaceutical Sciences; Tecnofarma; Laboratoire Dr. Renaud

- 2010: two Brazilian generics and over-the-counter companies; Aton Pharma

- 2011: PharmaSwiss SA; Ortho Dermatologics; iNova, which expanded its presence in Australia, Asia Pacific, and South Africa; Dermik, a dermatology unit of Sanofi (SNY); AB Sanitas; and Afexa Life Sciences

- 2012: OraPharma; assets from Swiss Herbal; University Medical; Gerot Lannach; Atlantis Pharma; Medicis Pharmaceuticals

- 2013: Natur Produkt International; Obagi Medical Products; Bausch + Lomb

- 2014: Solta Medical; PreCision Dermatology

- 2015: Dendreon; Salix Pharmaceuticals

In 2014, Valeant failed to acquire Allergan (AGN), which was later bought by Actavis (ACT).

After 2015, Valeant began to fall after controversy arose about price gouging and Valeant’s relationship with Philidor, an online pharmacy. For details on these controversies, please refer to Will Valeant’s Share Price Recover from the Recent Fall? and Has Valeant Gone Bottom Fishing?

For exposure to Valeant, you can invest in the VanEck Vectors Pharmaceutical ETF (PPH). PPH holds 1.6% of its assets in Valeant.

In the next part of this series, we’ll look at the rise and fall of Valeant, which was once a Wall Street favorite.