Are US Utilities Both Safe Havens and Overvalued?

The rush to US utilities despite their already stretched valuations indicates their safe-haven appeal amid global turmoil.

Dec. 4 2020, Updated 10:53 a.m. ET

Are European utilities earnings a concern?

Brexit may not have a significant impact on European utilities due to their regulated business model. In the medium to long term, though, a weaker currency and rising inflation could dent electricity demand, which could hammer utilities’ earnings.

European utilities are more attractive

Comparing US utilities with their European counterparts, US utilities (IDU) seem a bit expensive. With an average dividend yield of 5.2%, European utilities (EXH9) form an attractive proposition compared to the US power sector (XLU).

Due to the stark rise of US utilities in the last six months, their valuations have peaked at new highs this year. On the other hand, European utilities have corrected by more than 7% in the last year. By comparison, French nuclear giant Électricité de France currently yields 11%, while the United States’ largest nuclear generator Exelon (EXC) currently yields 3.7%.

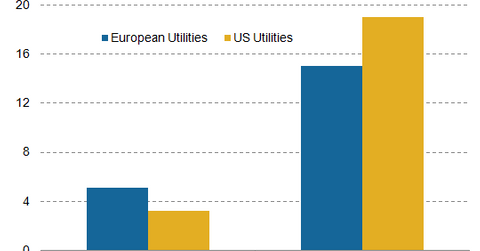

The forward dividend yields of European utilities is near 6%, while the forward yield of US utilities is ~3.5%–4.5%. The forward price-to-earnings ratio (or PE) of European utilities is 15x, while US utilities’ PE is over 18x.

US utilities are pricey with low yields

The iShares STOXX 600 Europe 600 Utilities UCITS ETF (EXH9) is a utilities-focused fund with National Grid, Iberdrola, Enel, and Engie as its top holdings. European utility giants are trading in the PE range of 13x–15x. Their US counterparts (DUK) (SO) (D) are trading much higher, near 19x. In this way, investors have to pay more for US utilities to get the relatively low yields they offer.

European utility ETFs

The SPDR MSCI Europe Utilities UCITS ETF (STU) is a Europe-focused fund and has UK’s National Grid as its top holding. STU invests 35% of its holdings in the United Kingdom. Iberdrola, Enel, and Engie collectively form nearly 30% of STU. The ETF has an average yield of nearly 4.9%. It has returned -8% in the last year.

The SPDR S&P International Utilities ETF (IPU) focuses on European utilities and has returned -6% in one year. The WisdomTree Global Utilities ETF (DBU) invests in global utilities excluding US utilities. It has an expense ratio of 0.58% and has returned -5% in one year.

The rush to US utilities despite their already stretched valuations indicates their safe-haven appeal amid global turmoil.