How Pfizer’s Business Segments Have Performed

As discussed, Pfizer’s (PFE) business is divided into two business segments, Innovative Health and Essential Health.

June 26 2018, Updated 5:05 p.m. ET

Pfizer’s segments

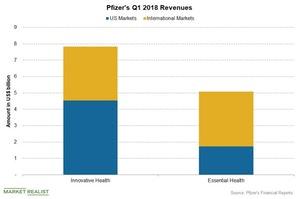

As discussed, Pfizer’s (PFE) business is divided into two business segments, Innovative Health and Essential Health. The chart below shows Pfizer’s segment-wise revenue in Q1 2018.

Innovative Health

Innovative Health comprises ~60% of Pfizer’s total revenue. In Q1 2018, the segment’s revenue rose ~6% YoY (year-over-year) to $7.8 billion, including 3% operating revenue growth and a 3% boost by foreign exchange. The growth was driven by strong sales of Chantix/Champix, Genotropin, Ibrance, Xalkori, Xeljanz, and other drugs, consumer healthcare products, and Eliquis and Xtandi alliance revenue.

Oncology revenue grew 26% YoY to ~$1.7 billion, while inflammation and immunology revenue was flat at ~$869 million. Internal medicine revenue fell 1% YoY to ~$2.3 billion, vaccine revenue was flat at ~$1.5 billion, and rare disease revenue grew 8% YoY to $549 million.

Essential Health

Essential Health comprises ~40% of Pfizer’s total revenue. In Q1 2018, the segment’s revenue fell 5% YoY to $5.1 billion, including a 9% operating revenue decrease and a 4% boost by foreign exchange. The decline was driven by lower Premarin, Medrol, Celebrex, and Peri-LOE[1.loss of exclusivity] product sales, and partially offset by strong sales of biosimilars.

Pfizer’s alliance revenue grew 30% YoY to $855 million from $656 million. Sterile injectable revenue fell 12% YoY, while Peri-LOE revenue fell 10% YoY. Legacy established product revenue grew 1% YoY, and biosimilar revenue grew ~66% YoY. The VanEck Vectors Pharmaceutical ETF (PPH) invests 4.9% of its holdings in Pfizer, 5.0% in Bristol-Myers Squibb (BMY), 4.9% in AstraZeneca (AZN), and 5.0% in GlaxoSmithKline (GSK).