Active Fund Management: Will It Make Passive Attractive?

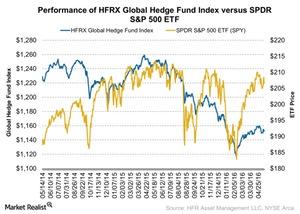

In recent years, the performance of various mutual funds and hedge funds followed by an active fund management strategy haven’t been so impressive.

June 9 2016, Published 9:52 a.m. ET

Why is the active fund management strategy unable to provide impressive performance?

In recent years, the performances of various mutual funds and hedge funds with an active fund management strategy haven’t been so impressive. Fund managers have struggled to generate alpha.

According to data provided by Morningstar, in the first four months of 2016, less than 35% of equity mutual funds that followed an active management strategy were able to beat their benchmark indexes. In 2015, 47% of actively managed equity mutual funds beat their benchmark indexes. It was only 26% in 2014.

Actively managed funds charge high fund management fees because their strategy involves continuously churning the portfolio with a goal of outperforming the benchmark index. That’s why the S&P 500 index (SPY) (IVV) provided a poor return in 2015.

So equity funds with an active management strategy aren’t able to provide impressive returns, as the equity market wasn’t supported in 2015. Poor returns with higher fund management fees disappointed investors.

Is a passive strategy looking attractive?

Laurence D. Fink of BlackRock said, “We fundamentally believe there will be a massive shift more into passive.” The new US (QQQ) (IWM) (VFINX) rule will also favor a passive investment strategy. The new rule says that brokers should put the client’s interest first when managing a client’s retirement investments. This will benefit a passive fund management strategy.

In the next part of this series, we’ll see how alpha plays an important role in a portfolio’s performance.