Major Macro Events in the Week Starting June 27

The final GDP is scheduled for June 28, 2016. It will be the major driver of markets in the week starting June 27. The GDP is expected to rise by 1.0%.

June 27 2016, Updated 11:09 a.m. ET

Major US indicator releases after a quiet last week

Last week’s focus was entirely on the Brexit—it called on for heavy volatility. For last week’s events, read Focus on Brexit, Volatility Expected to Rise in the Coming Week. This week, US data are expected to move the Market after last week’s quiet schedule.

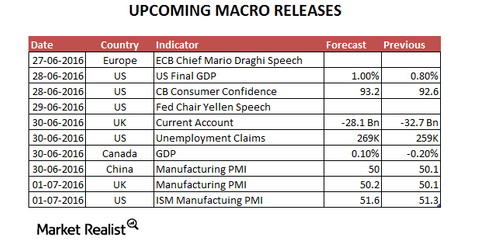

The final GDP (gross domestic product) is scheduled for June 28, 2016. It will be the major driver of markets in the week starting June 27. The GDP is expected to rise by 1.0%. The CB consumer confidence is also scheduled for the same day. Later in the week, the ISM manufacturing PMI (purchasing managers’ index) is scheduled for July 1. The manufacturing industry is expected to expand at a faster pace than the previous month.

Focus on the United Kingdom

The United Kingdom referendum to move away from the European Union will continue to create major headwinds in its economy this week. The Bank of England could intervene in the Market to arrest any heavy volatility. Major data releases for the week are the current account and manufacturing PMI. They’re scheduled for June 30 and July 1, respectively. Strong macro data could see a turnaround in the fortunes of British (FKU)(EWU) ETFs and ADRs (American depositary receipts) which had sharp falls on Friday.

China PMI will have a major impact on the emerging and oceania markets

The emerging market (EEM) and the Oceania markets (EWA)(VPL) took a heavy fall due to global uncertainty as a result of the United Kingdom’s referendum vote. Any rebound in the ETF’s trajectories in these regions will be heavily influenced by the Chinese PMI release on Friday. The Caixin manufacturing PMI is expected to be below 50, while the official Chinese manufacturing PMI is expected to be unchanged at 50.0