What Are J.M. Smucker’s Expectations for Fiscal 2017?

During its fiscal 4Q16 earnings release and in its investor presentation last week, the J.M. Smucker Company (SJM) discussed its outlook for fiscal 2017.

July 5 2016, Updated 12:07 p.m. ET

Key priorities in 2017

During its fiscal 4Q16 earnings release and in its investor presentation last week, the J.M. Smucker Company (SJM) discussed its outlook for fiscal 2017.

Its management mentioned that its key priorities in 2017 are to achieve synergy goals, to invest in new capabilities to enhance future growth, and to build on product innovation activities.

Projections for 2017

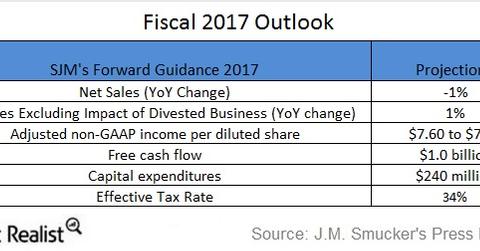

The company expects its fiscal 2017 net sales to fall by 1% due to its canned milk segment divestiture. Its net sales are projected to rise by 1% excluding the divestiture effect.

As we mentioned in the previous part, the company repurchased 3.4 million shares in fiscal 4Q16, keeping the outstanding number of shares at 116.6 million. Based on the share count, the company projects its adjusted non-GAAP (generally accepted accounting principles) EPS (earnings per share) to be in the range of $7.60–$7.75. Its gross profit is expected to benefit from $100 million worth of synergy realizations in 2017. Its gross margin is expected to be ~39%.

SJM’s earnings guidance includes $100 million worth of incremental synergies in fiscal 2017 and excludes its amortization expense of $208 million, or $1.18 per diluted share. The company expects $240 million worth of capital expenditure and free cash flow of $1.0 billion in fiscal 2017. Its effective tax rate is expected to be ~34%.

Segment expectations

In the U.S Retail Coffee segment, the company expects a fall in net sales due to lower pricing. It expects green coffee costs to remain favorable, contributing to moderate growth in operating profit. It expects this growth to continue in its Cafe Bustelo brand.

In the U.S. Retail Consumer Foods segment, the company expects both sales and operating profit to fall owing to the divestiture of the milk business. However, excluding this divestiture, sales and operating profit are projected to rise. SJM plans to build its recently launched brands such as Smucker’s Fruit & Honey Fruit Spreads and Jif snack bars. The company’s introduction of these new snack bar varieties and its expansion to other snacking platforms can be expected in fiscal 2017.

In the U.S Retail Pet Foods segment, net sales are projected to rise aided by contributions from new innovative products. SJM’s operating profit could also rise in the mid-single digits, benefiting from incremental synergies and new product contributions.

In the International and Foodservice segment, net sales are expected to show moderate growth with lower operating profits owing to currency translation effects on the cost of goods sold.

Smucker’s peer J&J Snack Foods (JJSF) is expected to see a revenue rise of 3% in fiscal 2016. TreeHouse Foods (THS) and Post Holdings (POST) are expected to see revenue rises of 96% and 10%, respectively, in fiscal 2016.

The PowerShares DWA Momentum ETF (PDP) and the First Trust Large Cap Core AlphaDEX ETF (FEX) have exposures of ~1.4% each to Smucker.