First Trust Large Cap Core AlphaDEX Fund

Latest First Trust Large Cap Core AlphaDEX Fund News and Updates

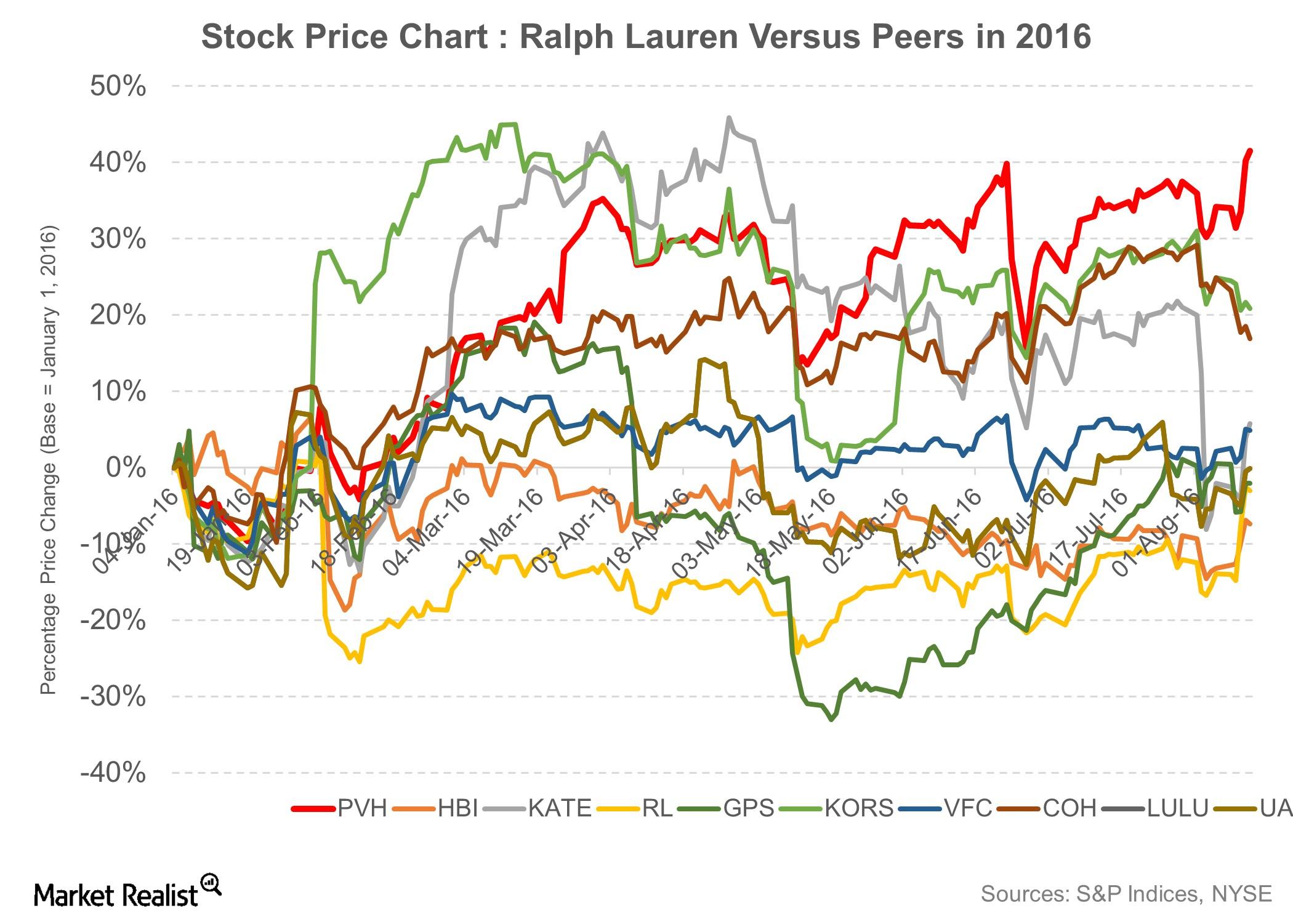

Better-than-Expected Earnings Support Falling Ralph Lauren Stock

Despite a decline in earnings, Ralph Lauren continues to hold $1.2 billion in cash and short-term investments on its balance sheet.

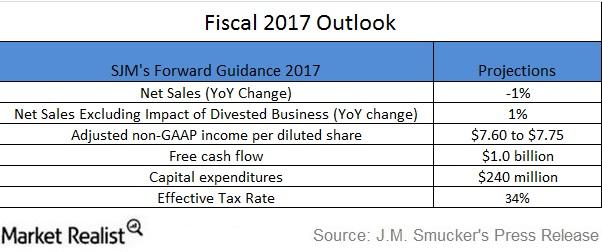

What Are J.M. Smucker’s Expectations for Fiscal 2017?

During its fiscal 4Q16 earnings release and in its investor presentation last week, the J.M. Smucker Company (SJM) discussed its outlook for fiscal 2017.

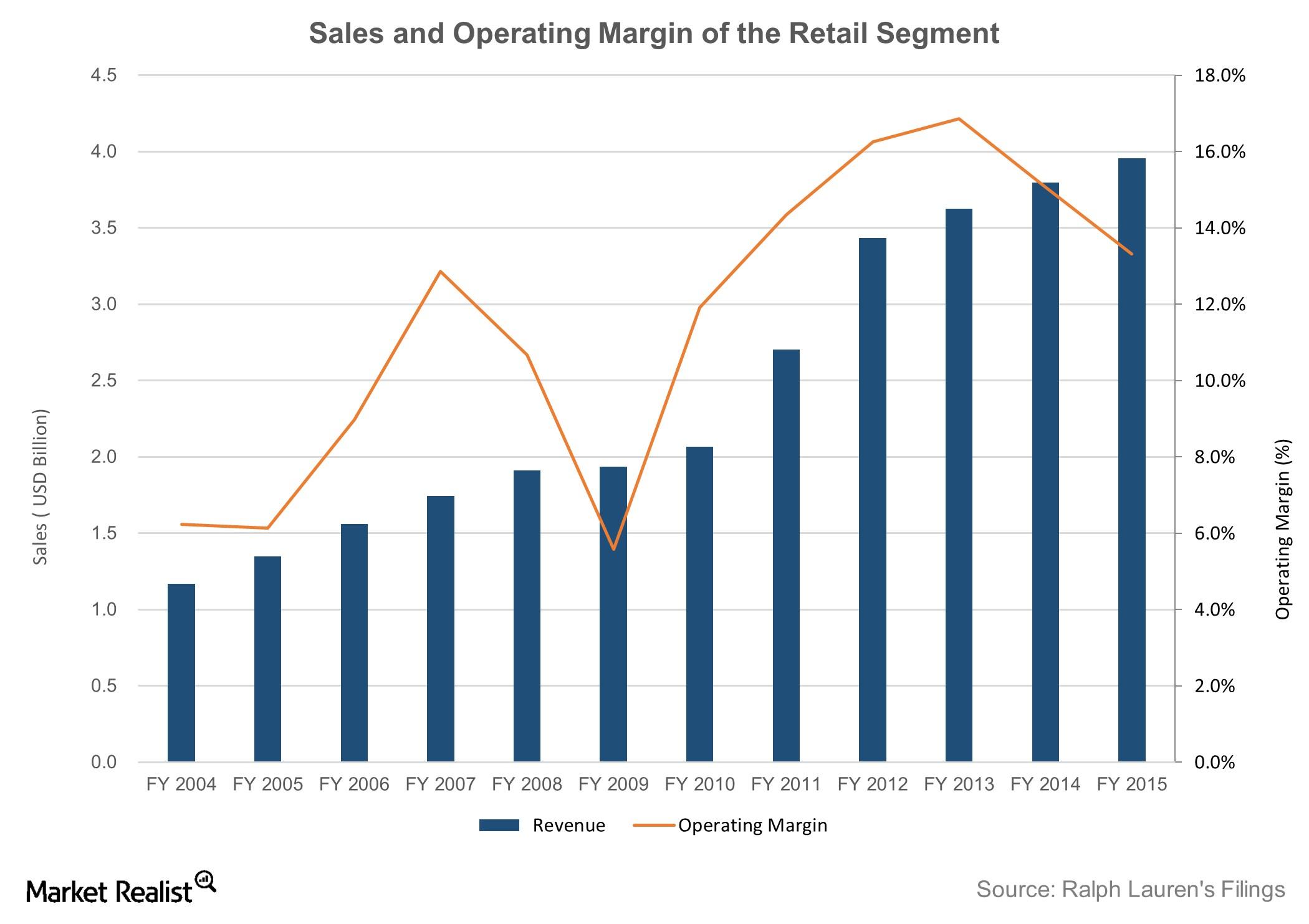

How Ralph Lauren’s Retail Channel Became the Biggest Revenue Generator

In retail, Ralph Lauren operated 143 Ralph Lauren stores, 64 Club Monaco stores, and 259 factory outlets at the end of fiscal 2015.