Introducing Denbury Resources

Denbury Resources primarily extracts oil and gas via carbon dioxide–based enhanced oil recovery (or EOR). This is also called tertiary oil recovery.

Feb. 27 2015, Updated 1:49 p.m. ET

Denbury Resources

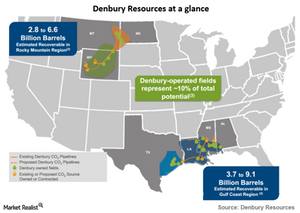

Denbury Resources (DNR) is an upstream oil and gas company based in Plano, Texas. Upstream means the company is primarily engaged in the production of oil and gas. Denbury produces mostly oil and operates in the Gulf Coast and Rocky Mountain regions, spanning Mississippi, Texas, Louisiana, Alabama, Montana, North Dakota, and Wyoming.

A different kind of oil company

Denbury Resources primarily extracts oil and gas via carbon dioxide–based enhanced oil recovery (or EOR). This is also called tertiary oil recovery, which we’ll discuss in the next article.

The company basically acquires oil fields that have been tapped out in terms of primary or secondary extraction methods. It then applies EOR to extract more oil from these reservoirs. As seen in the map above, Denbury Resources’s operational regions have huge potential for this kind of oil extraction.

This method of deriving most of its production makes the company unique among its upstream peers. However, other American energy companies like Occidental Petroleum (OXY), Apache Corp. (APA), and Anadarko Petroleum (APC) also use CO2 EOR.

Denbury Resources is a relatively small energy company with a market capitalization of just over $3 billion. Nevertheless, the company finds a place in the broad market SPDR S&P 500 ETF (SPY).

According to the company, its stated goal is “to increase the value of acquired properties through a combination of exploitation, drilling, and proven engineering extraction practices, with the most significant emphasis relating to tertiary recovery operations.”

Series focus

This series will focus on getting to know Denbury Resources from a qualitative perspective. We’ll follow up with another series that has a more quantitative focus on its historical financials.