Manas Chowgule, CFA

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Manas Chowgule, CFA

Energy & Utilities Must-know: An overview of Athlon Energy

Athlon is an independent oil and gas exploration and production company. Its activities include the acquisition, exploration, and development of oil and liquids-heavy gas resources in the Permian Basin.

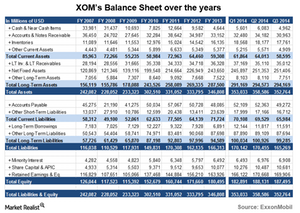

An essential analysis of ExxonMobil’s balance sheet

On a combination of several factors such as its earnings, share buybacks, and XTO acquisition, XOM’s balance sheet has grown.

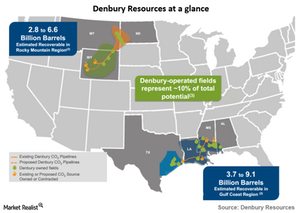

Introducing Denbury Resources

Denbury Resources primarily extracts oil and gas via carbon dioxide–based enhanced oil recovery (or EOR). This is also called tertiary oil recovery.

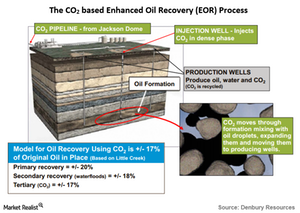

What’s special about Denbury Resources’s oil recovery method?

ConocoPhillips produces oil and gas via primary or secondary recovery methods. Denbury Resources mainly uses a tertiary, EOR method to produce its oil.

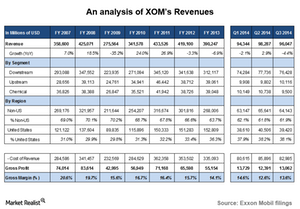

A key analysis of ExxonMobil’s revenues

ExxonMobil’s businesses and revenues depend on crude oil and natural gas’ price levels. In the first three quarters of 2014, ExxonMobil reported revenues of ~$290 billion.

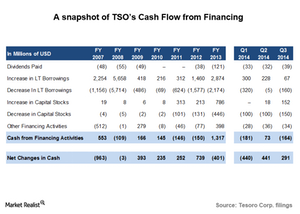

Tesoro’s cash flow from financing activities

Tesoro’s activities at the cash flow from financing level have been both a source and a destination for Tesoro’s cash over the years.

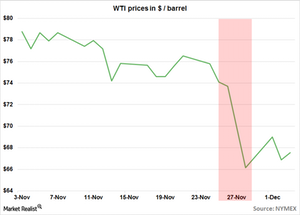

Why the bottom fell out of crude oil

Oil markets had been watching what OPEC would do in its November 27 meeting. Crude oil fell ~30% since June. It decided to stay production levels. Crude oil dropped ~10% after the news.