Can Delta Air Lines Increase Its Dividend Payouts in 2017?

Delta Air Lines started paying dividends only in 2013, and it’s one of the few airlines that pay dividends.

Jan. 17 2017, Updated 10:36 a.m. ET

New dividend payer

Delta Air Lines started paying dividends only in 2013, and it’s one of the few airlines that pay dividends. Most airlines find it difficult to even stay profitable during cyclical downturns. Fuel prices are a major cost for airlines, and the recent fall in crude oil prices helped airlines return to profitability.

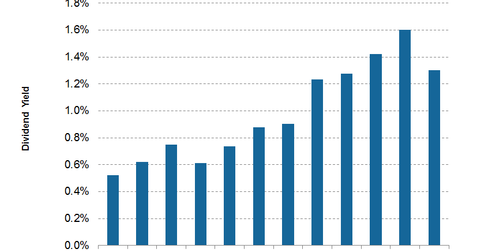

Dividend yield

DAL has an indicated dividend yield of 1.3%, the highest among the four airlines that pay dividends. Alaska Air Group (ALK) has the next highest indicated dividend yield of 1.2%. American Airlines (AAL) has an indicated dividend yield of 0.83%. Southwest Airlines (LUV) has a similar dividend yield of 0.8%.

Cash dividend coverage ratio

DAL’s cash dividend ratio stands at a strong 8x at the end of 4Q16, indicating its ability to sustain dividend payouts. The ratio is calculated as income before extraordinary items less minority and preferred dividend divided by dividends paid. It measures the ability of the company to pay dividends. A ratio of less than 1 indicates dividend payouts higher than the company’s cash flows which may be difficult to sustain in future.

Can dividend payouts increase?

Delta Air Lines has a history of increasing dividend payouts every four quarters. It first paid a dividend of $0.06 in 3Q13, increased it by 50% to $0.09 in 3Q14, and again increased it by 55% to $0.14 in 3Q15 and by 43% in 3Q16 to $0.2 per share.

S0 we can expect DAL’s dividends to stay at current levels for the next two quarters. Reuters analysts’ consensus also estimate dividends will stay at $0.2 for the next two quarters. DAL forms 1.4% of the PowerShares Dynamic Large Cap Value Portfolio (PWV).