Barclays Rated Mohawk Industries as ‘Overweight’

Mohawk Industries rose 0.04% to close at $204.44 per share on January 6, 2017. Its weekly, monthly, and YTD price movements were 1.1%, 4.8%, and 2.4%.

Jan. 10 2017, Updated 9:07 a.m. ET

Price movement

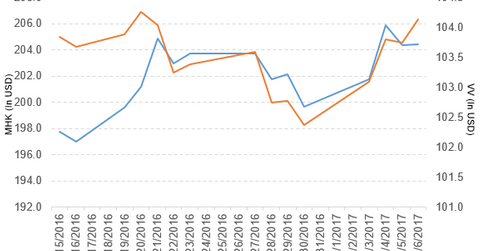

Mohawk Industries (MHK) has a market cap of $15.4 billion and rose 0.04% to close at $204.44 per share on January 6, 2017. The stock’s weekly, monthly, and YTD (year-to-date) price movements were 1.1%, 4.8%, and 2.4%, respectively, on the same day.

MHK is now trading 1.5% above its 20-day moving average, 4.0% above its 50-day moving average, and 2.9% above its 200-day moving average.

Related ETF and peers

The Vanguard Large-Cap ETF (VV) invests 0.06% of its holdings in Mohawk Industries. The YTD price movement of VV was 1.7% on January 6.

The market caps of Mohawk Industries’ competitors are as follows:

MHK’s rating

On January 6, 2017, Barclays has initiated the coverage of Mohawk Industries with “overweight” rating and also set the stock’s price target at $229.0 per share.

Mohawk’s performance in fiscal 3Q16

Mohawk Industries reported fiscal 3Q16 net sales of ~$2.3 billion—a rise of 6.5%, as compared to net sales of ~$2.2 billion in fiscal 3Q15. Sales from Global Ceramic, Flooring North America, and Flooring Rest of the World segments rose 3.9%, 5.6%, and 14.7%, respectively, in fiscal 3Q16 compared to fiscal 3Q15.

The company’s gross profit margin and operating margin rose 90 basis points and 310 basis points, respectively, in fiscal 3Q16 over fiscal 3Q15.

Its net income and EPS (earnings per share) rose to $269.9 million and $3.62, respectively, in fiscal 3Q16, as compared to $214.9 million and $2.89, respectively, in fiscal 3Q15. It reported adjusted EPS of $3.50 in fiscal 3Q16—a rise of 17.5% over fiscal 3Q15.

Mohawk’s cash and cash equivalents and inventories rose 1.3% and 3.2%, respectively, in fiscal 3Q16 as compared to fiscal 3Q15. Its current ratio rose to 1.2x, and its debt-to-equity ratio fell to 0.83x in fiscal 3Q16, as compared to a current ratio and a debt-to-equity ratio of 1.0x and 1.1x, respectively, in fiscal 3Q15.

The company has projected the EPS (earnings per share) in the range of $3.16–$3.25 per share, which excludes any restructuring charges, for fiscal 4Q16.

Now we’ll look at Avery Dennison (AVY).