James Hardie Industries PLC

Latest James Hardie Industries PLC News and Updates

Materials Business overview: The cement industry

Cement is classified into various categories based on its composition and specific end uses. Cement is classified as either portland, blended, or specialty cement. Investors can access the cement industry through the Vanguard FTSE Emerging Markets ETF (VWO).Materials Must-know: Cement’s final manufacturing process

The blend is heated in a rotary kiln. Gas, oil, or pulverized coal are used to ignite the flame at one end of the kiln. The clinker from the kiln passes into a cooler, where convective airflow cools the clinker for subsequent handling and grinding.

Moody’s Upgrades Mohawk Industries’s Notes to ‘Baa1’

Mohawk Industries (MHK) reported fiscal 3Q16 net sales of ~$2.3 billion—a rise of 6.5%, compared to net sales of ~$2.2 billion in fiscal 3Q15.

Barclays Rated Mohawk Industries as ‘Overweight’

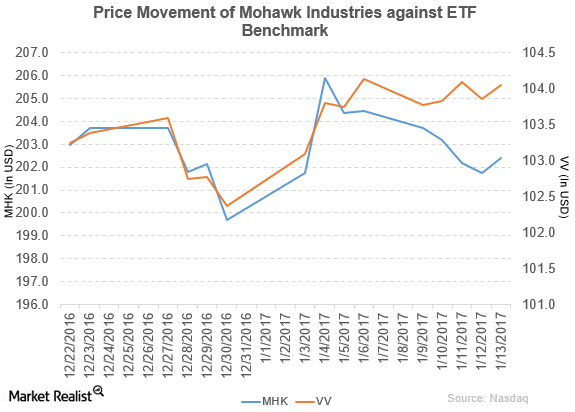

Mohawk Industries rose 0.04% to close at $204.44 per share on January 6, 2017. Its weekly, monthly, and YTD price movements were 1.1%, 4.8%, and 2.4%.

A Look at Mohawk Industries’s 3Q16 Earnings

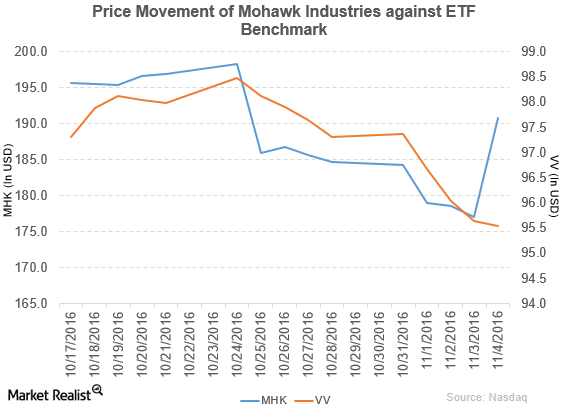

Mohawk Industries (MHK) has a market cap of $14.3 billion. It rose 7.8% to close at $190.75 per share on November 4, 2016.

Wells Fargo Rates Mohawk Industries as ‘Market Perform’

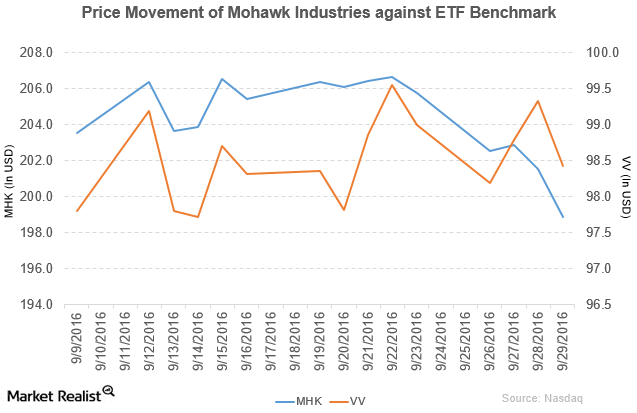

Price movement Mohawk Industries (MHK) has a market cap of $14.8 billion. It fell 1.3% to close at $198.86 per share on September 29, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -3.8%, -6.1%, and 5.0%, respectively, on the same day. MHK is trading 4.2% below its 20-day moving average, 4.6% […]

Bank of America Merrill Lynch Rates Mohawk Industries ‘Neutral’

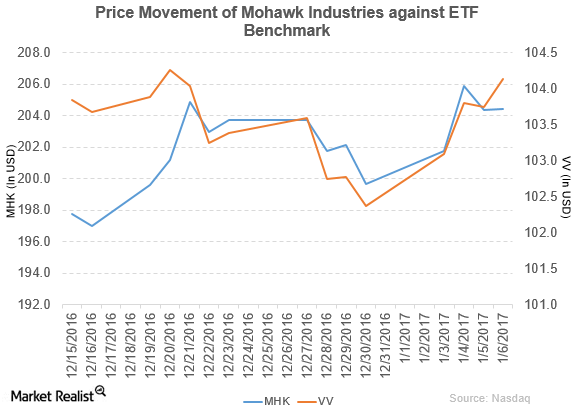

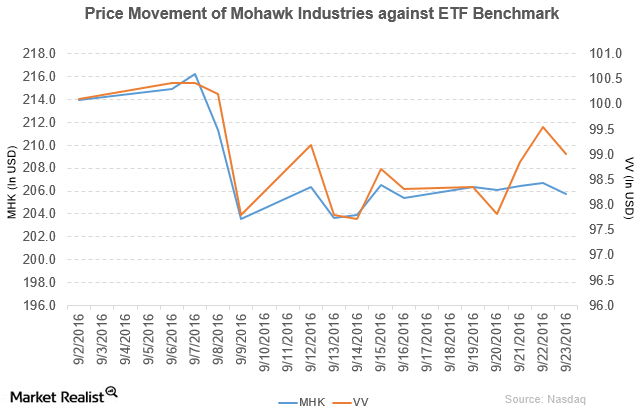

Price movement Mohawk Industries (MHK) has a market cap of $15.3 billion. It fell 0.45% to close at $205.75 per share on September 23, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 0.16%, -2.2%, and 8.6%, respectively, on the same day. MHK is trading 1.6% below its 20-day moving average, 1.1% […]

Mohawk Industries’ Earnings Results in Fiscal 2Q16

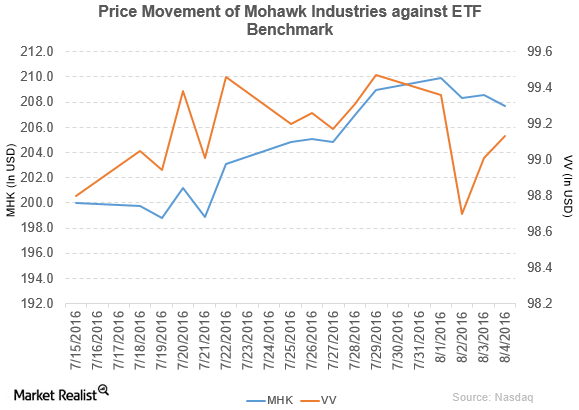

Mohawk Industries (MHK) has a market cap of $15.3 billion. It fell by 0.42% to close at $207.70 per share on August 4, 2016.

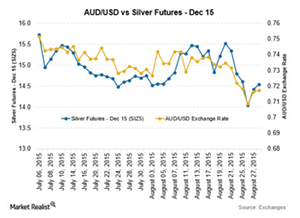

Silver Prices Show Positive Correlation with the Australian Dollar

Drop in silver prices among other precious metals With global commodity and metal prices falling in the volatile month of August, silver has been no exception. The economic slowdown in China has been slowing the demand across various commodities. Precious metals like gold and silver have been under pressure. The strength in the US dollar […]Materials Must-know: Factors that influence the cement industry

The cement industry is highly affected by regulatory norms. This is prominent in developed countries where environmental issues are more stringent. This adds to the companies’ costs.Materials Must-know: Cement industry drivers and indicators

An increased focus on infrastructure development increases cement demand. This effect is prominent in emerging economies. A substantial portion of this demand comes from infrastructure projects. The projects are funded by the government.Materials Must-know: The cost elements of cement

The cement industry relies on power. Power and fuel costs account for ~30% of the price of cement when it’s sold. As a result, power and fuel have a major impact on the company’s operating expenditure.Materials Must-know: Cement preparation

The company takes a sample of the limestone at various levels in the form of steps. The steps are called benches. The benches determine the quality assurance. Since quality varies, the bench compares it with the standard that’s required. This is called limestone benching.