Mohawk Industries Inc

Latest Mohawk Industries Inc News and Updates

Sidoti Rated HNI Corporation as ‘Neutral’

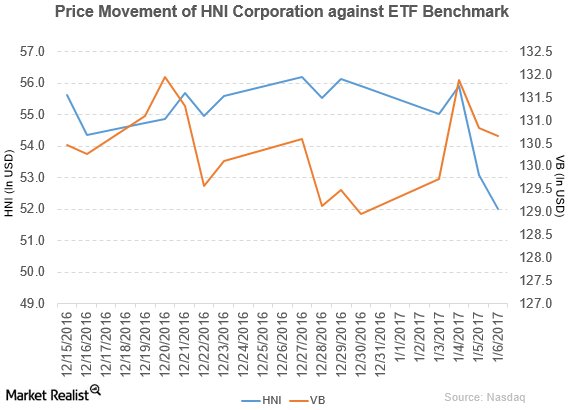

HNI Corporation fell 2.1% to close at $51.99 per share on January 6. Its weekly, monthly, and YTD movements were -7.4%, -3.2%, and -7.0%, respectively.

Moody’s Upgrades Mohawk Industries’s Notes to ‘Baa1’

Mohawk Industries (MHK) reported fiscal 3Q16 net sales of ~$2.3 billion—a rise of 6.5%, compared to net sales of ~$2.2 billion in fiscal 3Q15.

Barclays Rated Mohawk Industries as ‘Overweight’

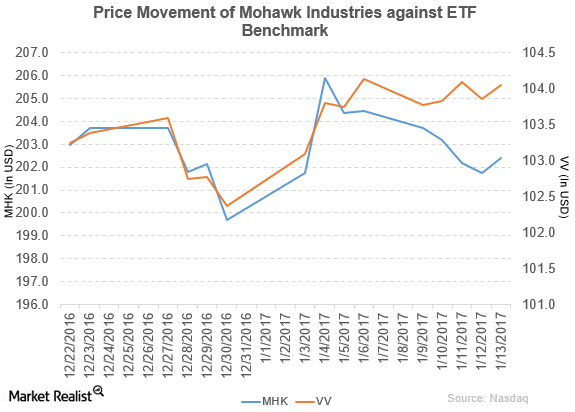

Mohawk Industries rose 0.04% to close at $204.44 per share on January 6, 2017. Its weekly, monthly, and YTD price movements were 1.1%, 4.8%, and 2.4%.

A Look at Mohawk Industries’s 3Q16 Earnings

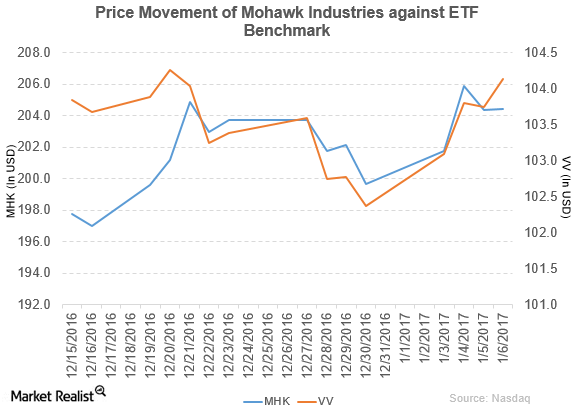

Mohawk Industries (MHK) has a market cap of $14.3 billion. It rose 7.8% to close at $190.75 per share on November 4, 2016.

Wells Fargo Rates Mohawk Industries as ‘Market Perform’

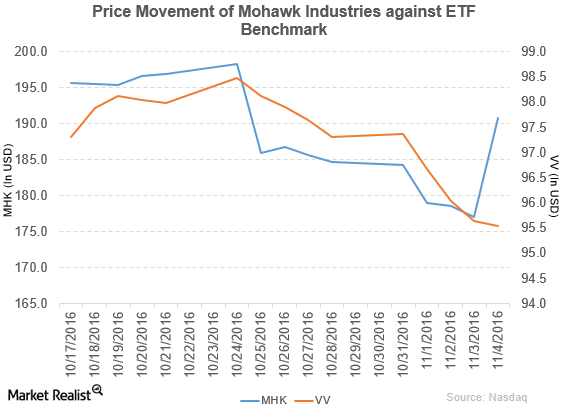

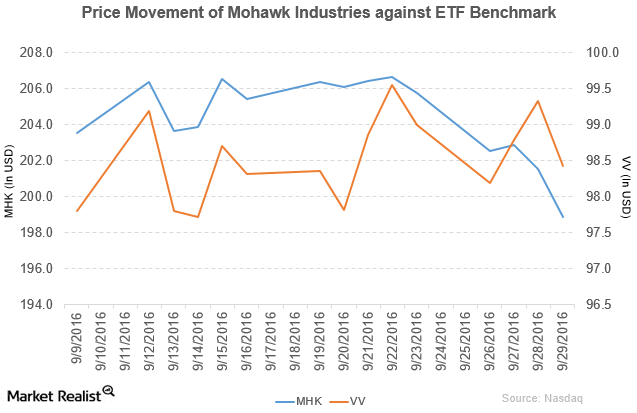

Price movement Mohawk Industries (MHK) has a market cap of $14.8 billion. It fell 1.3% to close at $198.86 per share on September 29, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -3.8%, -6.1%, and 5.0%, respectively, on the same day. MHK is trading 4.2% below its 20-day moving average, 4.6% […]

Bank of America Merrill Lynch Rates Mohawk Industries ‘Neutral’

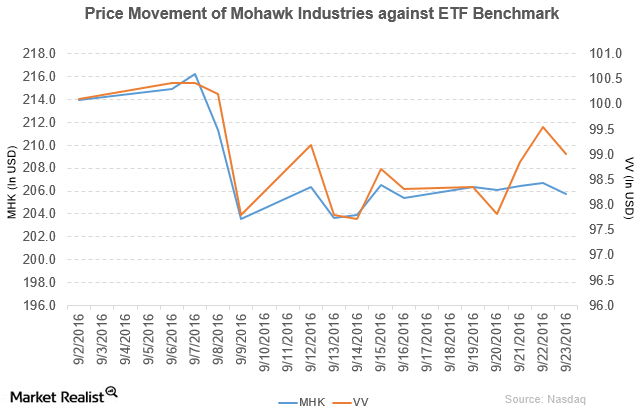

Price movement Mohawk Industries (MHK) has a market cap of $15.3 billion. It fell 0.45% to close at $205.75 per share on September 23, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 0.16%, -2.2%, and 8.6%, respectively, on the same day. MHK is trading 1.6% below its 20-day moving average, 1.1% […]

Mohawk Industries’ Earnings Results in Fiscal 2Q16

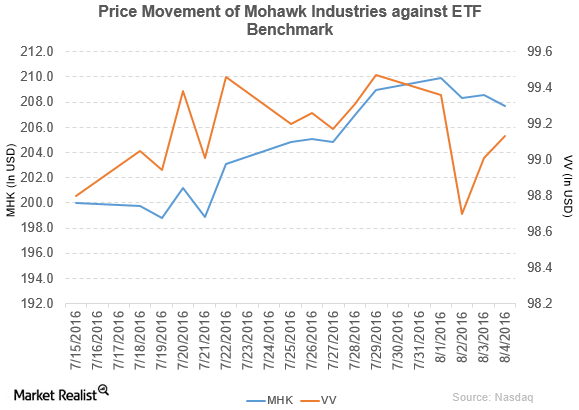

Mohawk Industries (MHK) has a market cap of $15.3 billion. It fell by 0.42% to close at $207.70 per share on August 4, 2016.

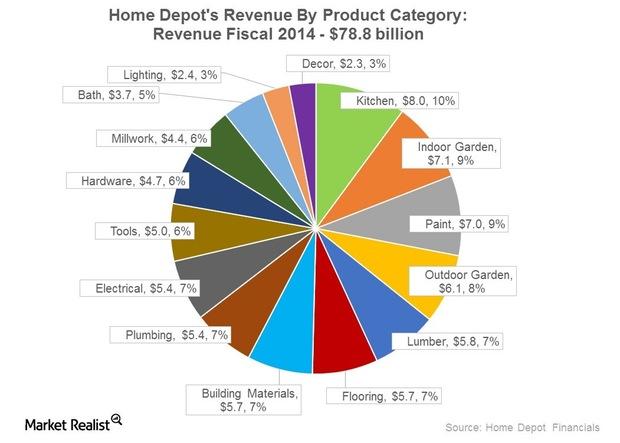

Home Depot’s Product Portfolio and Supplier Relationships

Kitchen and garden products are the best-grossing product categories. These accounted for nearly 27% of revenues in fiscal 2014.