What Slowdown? US Steel Prices Rose 50% This Year

Steel companies’ earnings are sensitive to changes in steel prices. In recent quarters, their earnings have been negatively impacted by falling steel prices.

May 26 2016, Updated 9:08 a.m. ET

US steel prices

Steel companies’ earnings are sensitive to changes in steel prices. In recent quarters, their earnings have been negatively impacted by falling steel prices. In this part of the series, we’ll look at spot carbon flat product prices. Flat steel products consist of sheets and plates that are used in a wide range of industries such as the automobile, domestic appliances, shipbuilding, and construction sectors. Hot rolled coil (or HRC), cold rolled coil (or CRC), and hot dip galvanized (or HDG) sheets are among the most widely used flat steel products.

Prices skyrocket

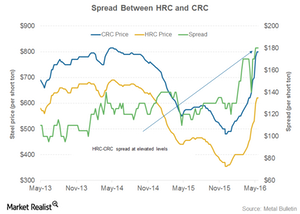

The graph above shows the recent trend in spot HRC prices. As you can see, prices have risen sharply in the last couple of years. Spot HRC prices have risen more than 65% this year and are currently at the highest level since December 2014. Spot CRC prices have also increased more than 63% so far this year. However, the HRC-CRC spread is still at historically high levels.

HRC-CRC spread

The higher CRC-HRC spread can be attributed to steep duties on imports of CRC products. Also, CRC demand has been stronger compared to the more commodity grade (GCC) HRC products. Note that CRC and corrosion-resistant steel products are used in consumer products such as automobiles and appliances. Both these sectors have been strong thanks to US consumer appetites.

Higher spot steel prices would benefit steel companies such as United States Steel (X), Nucor (NUE), and Commercial Metals (CMC). However, it would be fair to say that not many, including service centers such as Reliance Steel & Aluminum (RS), expected such a big price rise given the level of overcapacity in the industry.

In the next part of the series, we’ll look at the trend in the raw material market.