Norfolk Southern’s Intermodal Slump Equitable with Rival CSX

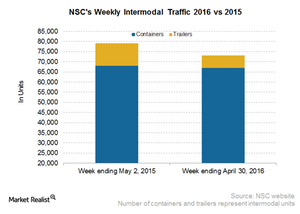

Norfolk Southern’s (NSC) total intermodal traffic for the week ended April 30, 2016, declined by 7.6%, at nearly 73,000 containers and trailers. This compares with 79,000-plus units in the corresponding week of 2015.

Dec. 4 2020, Updated 10:53 a.m. ET

Norfolk Southern’s intermodal

Norfolk Southern’s (NSC) total intermodal traffic for the week ended April 30, 2016, declined by 7.6%, at nearly 73,000 containers and trailers. This compares with 79,000-plus units in the corresponding week of 2015. Offering some respite to this dominant Eastern US player, container traffic fell from 68,000 units in the week ended May 2, 2015, to 67,000 units in the reported week of 2016.

Trailer’s traffic fell by 44.7% in the week ended April 30, 2016, on a year-over-year basis. Although NSC’s intermodal volumes declined in the reported quarter, its rival CSX also reported an almost equal decline in intermodal traffic.

NSC’s sizable drop in trailer volumes is primarily attributed to the restructuring of the underperforming subsidiary, Triple Crown Services (or TCS). TCS, through specialized equipment RoadRailer trailer, provides service in the Eastern US and Ontario and Quebec.

Why is intermodal traffic important?

Intermodal traffic includes the movement of containers and trailers. Normally, containers’ share of total intermodal traffic is much higher than the trailers’ share. Including NSC, all major railroads such as CSX (CSX), Union Pacific (UNP), BNSF Railway (BRK-B), Genesee & Wyoming (GWR), and Kansas City Southern (KSU) have pumped substantial dollars toward intermodal growth.

The intermodal businesses of all major US railroads face strong competition from the trucking industry. Railroads are four times more fuel efficient than trucks. However, the fall in fuel prices in 2015 made truckers more competitive. For specific time-sensitive deliveries, truckers proved to be more efficient than railroads.

Investing in ETFs

Railroads form part of the industrial sector. Investors opting for broad-based exposure in the transportation and logistics sector can invest in the iShares US Industrials ETF (IYJ). All major US railroads make up 5% of the portfolio holding of IYJ.

For more information on the last week’s rail traffic, please visit Market Realist’s Week Ending April 23: North American Rail Traffic Fell.

In the next part, we will go through the rail traffic of Norfolk Southern’s competitor, CSX Corporation (CSX).