Microsoft Issued the Most High-Grade Bonds Last Week

Microsoft (MSFT) issued Aaa/AAA rated high-grade bonds worth $19.8 billion through seven parts on August 1, 2016.

Aug. 9 2016, Published 3:04 p.m. ET

Deals overview

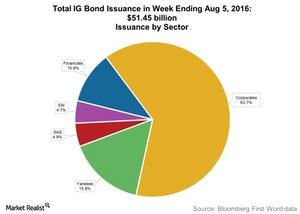

US corporates dominated the primary market for high-grade bonds in the week ended August 5, 2016. They made up 63.7%, or $32.8 billion, of all issues. Yankee issuers made up 15.9%, while US financials issuers made up the remaining 10.9% of the total issuance.

The week ended August 5 brought the year-to-date issuance of high-grade corporate bonds to $1.1 trillion. That was 2% higher than the issuance in the same period in 2015.

Issuances by high-grade corporates form part of the Vanguard Total Bond Market ETF (BND), the iShares 1-3 Year Credit Bond (CSJ), and the SPDR Barclays Short Term Corporate Bond ETF (SCPB).

Details of the Microsoft issue

Microsoft (MSFT) issued the following Aaa/AAA rated high-grade bonds worth $19.8 billion in seven parts on August 1, 2016:

- $2.5 billion in 1.1% three-year notes issued at a spread of 35 bps (basis points) over similar-maturity Treasuries

- $2.8 billion in 1.6% five-year notes issued at a spread of 50 bps over similar-maturity Treasuries

- $1.5 billion in 2.0% seven-year notes issued at a spread of 70 bps over similar-maturity Treasuries

- $4.0 billion in 2.4% ten-year notes issued at a spread of 90 bps over similar-maturity Treasuries

- $2.3 billion in 3.5% 20-year bonds issued at a spread of 120 bps over similar-maturity Treasuries

- $4.5 billion in 3.7% 30-year bonds issued at a spread of 145 bps over similar-maturity Treasuries

- $2.3 billion in 4.0% 40-year bonds issued at a spread of 180 bps over similar-maturity Treasuries

The company intends to use the proceeds of the loan to fund its purchase of LinkedIn (LNKD).

Details of the UBS Group Funding (Jersey) issue

UBS Group Funding (Jersey), a subsidiary of UBS Group AG (UBS), issued A-/A high-grade bonds worth $2.5 billion on August 3, 2016, in the following two parts:

- $500 million in long five-year FRNs (floating rate notes) issued at LIBOR + 153 basis points

- $2.0 billion in 2.7% long five-year notes issued at a spread of 160 bps over similar-maturity Treasuries

Details of the JPMorgan Chase issue

JPMorgan Chase (JPM) issued high-grade bonds worth $2.5 billion on August 3, 2016. The single-tranche A3/A- rated five-year non-callable for four years issue was raised at a coupon of 2.3%. The high-grade bonds were issued at a spread of 123 bps over similar-maturity Treasuries.

Details of the International Paper issue

International Paper (IP) issued Baa2/BBB high-grade bonds worth $2.3 billion on August 2, 2016, through the following two parts:

- $1.1 billion in 3.0% 10.5-year bonds issued at a spread of 150 bps over similar-maturity Treasuries

- $1.2 billion in 4.4% 41-year bonds issued at a spread of 210 bps over similar-maturity Treasuries

In the next part, we’ll look at investment-grade bond fund flows.