Comparing Boeing’s Valuation to Its Peers

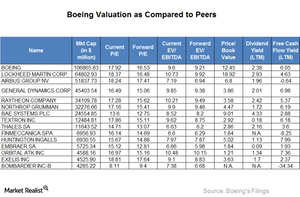

Boeing is the largest company by market capitalization among our selected peers, while Bombardier is the smallest.

April 9 2015, Updated 12:47 p.m. ET

Boeing’s valuation

In this article, we will take a look at Boeing’s valuation compared to its peers. As you can see in the table below, Boeing (BA) is the largest company by market capitalization among our selected peers, while Bombardier is the smallest.

Price-to-earnings ratio

The PE ratio is the ratio between the current share prices and the past earnings per share (or EPS). The selected peer group’s price-to-earnings ratio (or PE) is 16.16, while Boeing’s PE ratio is 17.92. The average forward PE of the peer group is 14.8, and Boeing’s average forward PE is 16.53. This indicates that the market is expecting the company to have a good year.

EV/EBITDA

Forward EV/EBITDA is a useful metric to gauge relative valuation. A lower forward multiple compared to the present ratio typically indicates expectations of EBITDA growth for the period. For Boeing, this multiple stands at 9.21 compared to the current 9.26.

Of the companies listed in the above chart, Orbital ATK (OA-2) has the highest EV/EBITDA (or enterprise value to earnings before interest, tax, depreciation, and amortization) multiple, followed closely by Lockheed Martin (LMT) and Raytheon (RTN). Boeing’s EV/EBITDA multiple is 9.6, which is significantly higher than its archrival Airbus.

Price-to-book value ratio

As shown in the chart above, Boeing’s price-to-book value ratio (or PBV) is the second highest after Lockheed Martin (LMT). This indicates that the company has been earning high returns on equity and that the market expects the company to continue doing so. However, it is likely that all good news is already priced in the stock.

The PBV ratio is the ratio between the current share prices and the book value per share. It indicates how much people are willing to pay for a company’s net assets.

Boeing forms 5.55% of the Dow Jones Industrial Average ETF (DIA) and 3.64% of the iShares US Industrials ETF (IYJ).