What Are Analysts’ Recommendations for Tesla?

As of April 5, Tesla stock had ~23% positive returns in the past year. According to analysts’ consensus, Tesla’s target price for the next year was $254.76.

Nov. 20 2020, Updated 5:20 p.m. ET

Analysts’ recommendations

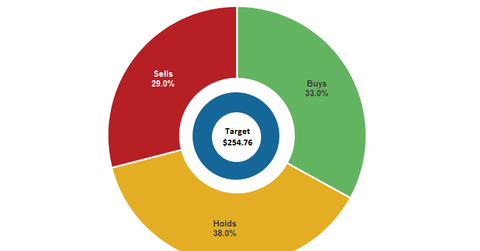

According to recent data compiled by Reuters, 33% of the analysts covering Tesla (TSLA) gave the stock a “buy” recommendation, while 38% of the analysts gave a “hold” recommendation.

The remaining 29% of the analysts expect the company’s stock price to remain weak. They gave it a “sell” recommendation.

Consensus target price

As of April 5, 2017, Tesla stock yielded ~23% positive returns in the past year. According to Wall Street analysts’ consensus, Tesla’s target price for the next year was $254.76. It’s already much higher than its market price of $295.

Despite the recent rally in Tesla stock, most analysts maintained conservative price targets on Tesla. Concerns about Tesla’s ability to produce Model 3 on time along with skepticism about its 1Q17 results could be two primary reasons for conservative price targets.

Tesla’s consumers and investors have been loyal to the company since the beginning, which surprised critics on many occasions. Notably, Tesla has a huge fan base that sets it apart from other automakers including General Motors (GM), Ford (F), and Fiat Chrysler (FCAU).

1Q17 earnings season

The auto industry’s (XLY) 1Q17 earnings season is about to start. Harley-Davidson (HOG) will release its earnings on April 18. Mainstream automakers such as General Motors, Ford, and Fiat Chrysler are expected to announce their first quarter results in the final week of April 2017.

Auto investors can stay updated about analysts’ estimates for these earnings by visiting Market Realist’s Auto page.