Jazz Pharmaceuticals: How Are Xyrem and Erwinaze Positioned?

Jazz Pharmaceuticals’ Xyrem generated revenues of $357.3 million in the third quarter—compared to $303.9 million in the third quarter of 2017.

Nov. 13 2018, Updated 11:10 a.m. ET

Xyrem’s revenue trends

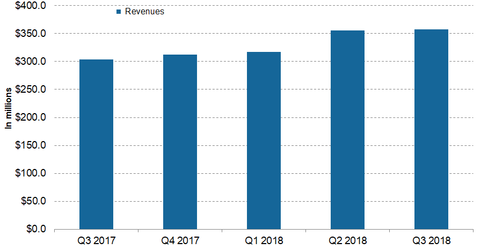

Jazz Pharmaceuticals’ (JAZZ) Xyrem generated revenues of $357.3 million in the third quarter—compared to $303.9 million in the third quarter of 2017, which reflected ~18% YoY (year-over-year) growth. Xyrem’s net revenues over the first nine months of 2018 amounted to $1.0 billion—compared to $874.2 million in the same period in 2017, which reflects 18% YoY growth.

Jazz Pharmaceuticals expects the net revenues from Xyrem sales to be $1.39 billion–$1.40 billion in 2018.

In October, the FDA approved Jazz Pharmaceuticals’ supplemental new drug application for Xyrem’s label expansion. The expansion includes the drug’s use for treating narcolepsy patients above seven years old with cataplexy or excessive daytime sleepiness. Xyrem’s label expansion is expected to boost the drug’s revenue growth in the fourth quarter and beyond.

Xyrem’s revenue growth could boost Jazz Pharmaceuticals’ revenue growth, which could boost the Pharmaceutical ETF’s (PPH) share prices. Jazz Pharmaceuticals accounts for ~4.41% of PPH’s total portfolio holdings.

In the marketplace, Xyrem competes with Shire’s (SHPG) Adderall XR, Novartis’ (NVS) Ritalin, and Teva Pharmaceuticals’ (TEVA) Provigil.

Erwinaze’s revenue trends

Erwinaze reported revenues of $41.1 million in the third quarter—compared to $49.2 million in the third quarter of 2017, which reflects a decline of ~16% YoY. Erwinaze reported net revenues of $150.5 million over the first nine months of 2018—compared to $149.6 million in the third quarter of 2017.

Jazz Pharmaceuticals expects the net revenues from Erwinaze sales to be $165.0 million–$175.0 million in 2018.