What’s Next for Gold Investors?

Gold gave steady returns to investors for the first two months of 2016 as unrest and instability continued in the markets. However, March started with some ups as well as downs for gold.

April 19 2016, Published 8:18 p.m. ET

Global implications for gold

After witnessing the best quarter in almost three decades, investors are expecting gold to move sideways for the second quarter of 2016. With the Chinese markets recovering from their recent fall, safe-haven bids may be expected to vanish slowly. However, the dipping global interest rates may lift the demand for this non-yield bearer, helping its price.

Gold gave steady returns to investors for the first two months of 2016 as unrest and instability continued in the markets. However, March started with some ups as well as downs for gold. As of April 18, gold has posted a 2% loss on a five-day trailing basis. However, silver and palladium maintained gains of ~0.4% and 4.3%, respectively, during the same timeframe.

[marketrealist-chart id=1222923]

Funds and miners

The instability in gold and silver on Monday brought down the precious metal funds, including the SPDR Gold Shares ETF (GLD) and the iShares Silver Trust ETF (SLV). These two funds fell by 0.15% and 0.26%, respectively.

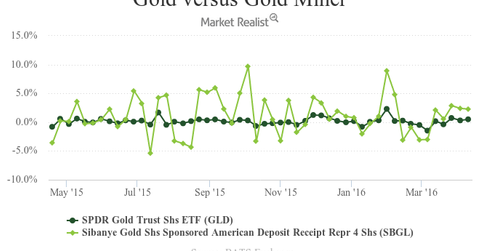

Among the biggest losers on Monday, Primero Mining (PPP), Aurico Gold (AUQ), and Sibanye Gold (SBGL) fell by 16.2%, 2.8%, and 2.9%, respectively, on Monday. The comparative performance of GLD alongside Sibanye Gold is shown in the above chart.

What’s next?

The most important determinant for gold under the current circumstances is the Federal Reserve’s call for an interest rate hike. With the recent upbeat economic data from the US and hawkish comments from the Fed’s decision-makers officials, investors are remaining curious.

However, the global downward sticky interest rates continue to concern the members of the Fed with respect to the appropriate time for an interest rate hike.

Charles Evans, president of the Chicago Federal Reserve, noted on April 15, 2016, that the Fed is unlikely to raise interest rates when it meets later this month. However, it seems to be on track for at least two increases over the rest of the year. An interest rate hike could subdue precious metals as well as the mining companies.