Tesla Motors Rose Due to Increased Orders for the Model 3 Sedan

Tesla Motors (TSLA) has a market cap of $31.5 billion. It rose by 4.0% and closed at $246.99 per share on April 4, 2016.

Dec. 4 2020, Updated 10:53 a.m. ET

Price movement

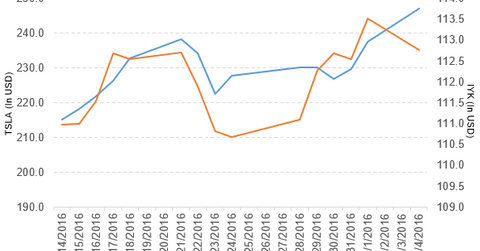

Tesla Motors (TSLA) has a market cap of $31.5 billion. It rose by 4.0% and closed at $246.99 per share on April 4, 2016. The price movements on a weekly, monthly, and YTD (year-to-date) basis were 7.3%, 26.2%, and 2.9%, respectively.

Currently, Tesla is trading 11.7% above its 20-day moving average, 26.7% above its 50-day moving average, and 8.3% above its 200-day moving average.

The iShares Dow Jones US Consumer Goods Sector Index Fund (IYK) invests 1.1% of its holdings in Tesla Motors. IYK tracks a market-cap-weighted index of stocks in the US consumer goods sector. IYK’s YTD price movement was 5.3% as of April 1, 2016.

The market caps of Tesla Motors’ competitors are as follows:

Performance in 1Q16

Tesla Motors delivered 14,820 vehicles in 1Q16. This includes 12,420 Model S vehicles and 2,400 Model X vehicles—a rise of 50% compared to the same period last year. According to the company, it’s on track to deliver 80,000–90,000 new vehicles in 2016.

The delivered vehicles in the first quarter were below the company’s expectation of 16,000 vehicles due to the shortage of parts of Model X in January and February. Production was on track in March with 750 Model X vehicles produced every week.

This shortage of parts was due to new technology for the Model X in version 1, insufficient supplier capacity, and the company’s inability to manufacture the parts in-house.

The company received 276,000 orders for the Model 3 sedan. The company ensured that it would take care of these issues for the Model 3 launch.

According to Elon Musk, Tesla’s chief executive, “The company aims to boost annual production to 500,000 units by 2020 after the introduction of the mass-market Model 3.”

For an ongoing analysis of this sector, please visit Market Realist’s Consumer Discretionary page.