Will Constellation Brands’ Fiscal 1Q17 Earnings Beat Estimates?

For fiscal 1Q17, analysts expect Constellation Brands to deliver adjusted EPS (earnings per share) of $1.52.

Nov. 20 2020, Updated 1:51 p.m. ET

Strong growth expectations

Analysts expect Constellation Brands (STZ) to report strong earnings growth in 1Q17 and fiscal 2017 following an impressive performance by the company in the previous fiscal year. The company is scheduled to announce its results for fiscal 1Q17, which ended on May 31, 2016, on June 30.

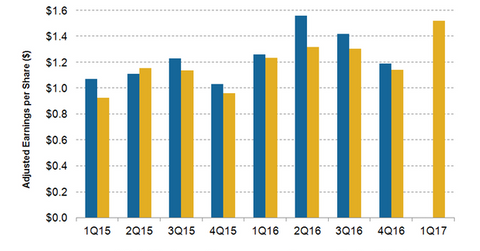

For fiscal 1Q17, analysts expect Constellation Brands to deliver adjusted EPS (earnings per share) of $1.52. This estimate reflects a 20.6% rise in adjusted EPS compared to the first quarter of the previous fiscal year. For fiscal 2017, analysts expect adjusted EPS to rise by 16% to $6.30.

Recap of previous performance

In fiscal 4Q16, which ended on February 29, 2016, Constellation Brands reported a 15.5% rise in its adjusted EPS. The company’s adjusted EPS of $1.19 exceeded the consensus estimate of $1.14. Constellation Brands’ earnings exceeded analysts’ expectations in all four quarters of fiscal 2016.

The strong earnings growth in 4Q16 was driven by the company’s higher sales and improved margins. As discussed in the third part of this series, Constellation Brands’ margins are benefiting from its “premiumization” strategy, which involves a focus on high-margin, high-growth premium beer and wine products. The iShares Global Consumer Staples ETF (KXI) has 0.8% exposure to Constellation Brands.

For fiscal 2016, Constellation Brands was ahead of its peers with adjusted EPS growth of 22.3%. In 2015, Anheuser-Busch InBev (BUD) and Molson Coors Brewing Company (TAP) reported declines of 4.1% and 9%, respectively, in their adjusted EPS. For the fiscal year ending on April 30, 2016, Brown-Forman (BF.B) reported 7.8% growth in its adjusted EPS.

Company’s expectations

Based on the guidance issued in April 2016, Constellation Brands expects its adjusted EPS in fiscal 2017 to be in the range of $6.05–$6.35. This compares to adjusted EPS of $5.43 in fiscal 2016. The company’s fiscal 2017 earnings are expected to benefit from higher beer sales and the addition of premium products through recent the acquisitions of the Meiomi wine brand and Ballast Point.

In the next part of this series, we’ll discuss the company’s stock price movement.

Correction: When this article was originally published, it mistakenly indicated the following: “For 4Q15, Anheuser-Busch InBev (BUD) and Molson Coors Brewing Company (TAP) reported declines of 4.1% and 9%, respectively, in their adjusted EPS.” These results were for 2015, and we have updated the post with this revision. We regret this error.