What Are the Challenges for the Pharmaceutical Industry in Japan?

Japan is the second-largest individual pharmaceutical market in the world. It accounts for less than 10% of the total global pharma market.

Nov. 20 2020, Updated 5:31 p.m. ET

Pharmaceutical industry in Japan

Japan is the second-largest individual pharmaceutical market in the world. It accounts for less than 10% of the total global pharma market. The country’s pharma market is expected to grow annually by ~2.2%.

Generic drug promotion in Japan

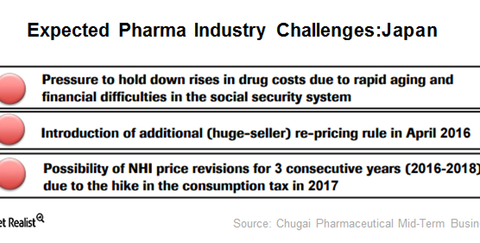

The increasing aging population is putting pressure on government healthcare expenditures in the country. Currently, the population over 65 years of age constitutes ~26% of the total population in Japan. This is expected to increase in the near term. Thus, the Japanese government has adopted certain cost containment measures such as the promotion of generic drugs and biennial drug pricing revisions.

Prescription branded drugs dominate the market, and generic drugs constitute only ~30% of total sales. The generic drug penetration in the country is expected to reach 60% in fiscal 2017 followed by 70% in fiscal 2025. Thus, generic drug companies could see opportunities in the Japanese markets.

With the higher expected demand for generics, big pharma companies in the country are coming together to form joint ventures to cater to this demand. One such example is the venture between Takeda Pharmaceutical (TKPYY) and Teva Pharmaceutical (TEVA).

To see if Japanese markets are a good option for you, please refer to Investing in Japan Could Be a Viable Option.

The Vanguard FTSE All-World ex-U.S. ETF (VEU) has exposure to large- and mid-cap stocks from all countries excluding the United States. Sanofi (SNY) and GlaxoSmithKline (GSK) make up 0.6% and 0.59% of the fund’s total assets, respectively. This fund has a 0.1% weight in Ono Pharmaceutical, whereas Teva and Takeda make up ~0.37% and ~0.23% of the fund, respectively.