Behind Ralph Lauren’s Historical Financial Performance

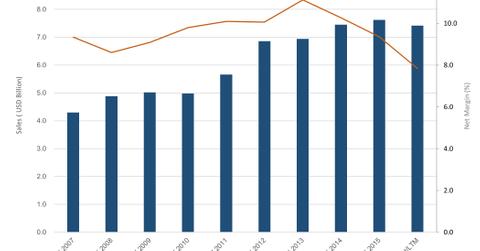

Ralph Lauren’s top line has grown by a CAGR of around 9% over the past five fiscal years to reach $7.6 billion in fiscal 2015.

April 29 2016, Updated 11:06 a.m. ET

Retail segment and top-line growth

Ralph Lauren’s (RL) top line has grown at a CAGR (compounded annual growth rate) of around 9% over the past five fiscal years to reach $7.6 billion in fiscal 2015. This growth has been fueled by organic as well as inorganic endeavors.

Retail has been the fastest-growing segment (~14% five-year CAGR), followed by Wholesale (5% five-year CAGR). Over the past several years, RL has been focusing on increasing its retail store base and online presence to gain better control over its brands and operations. This has resulted in a higher share of revenues coming from the Retail segment.

Licensing revenue, on the other hand, has declined (-1.6% five-year CAGR) because the company has taken direct control of some of its licensing businesses.

By comparison, HanesBrands (HBI) has expanded by around 6% while Coach (COH) has grown by around 3% during the past five fiscal years. PVH Corporation (PVH) and VF Corporation (VFC) have displayed better growth, increasing their sales by 28% and 11%, respectively, over the same period.

Margin trends and peer comparisons

RL’s average operating margin was about 15% between 2010 and 2015. But there has been some margin pressure lately due to currency headwinds and a higher promotional environment. RL has recorded an operating margin of 9.5% over the last twelve months.

By comparison, VF Corporation (VFC), HanesBrands (HBI), and Coach (COH), have displayed better performances, recording operating margins of 13.5%, 10.4%, and 13.3%, respectively, over the past twelve months. RL’s close competitor, PVH Corporation (PVH), which owns Tommy Hilfiger and Calvin Klein, has displayed a similar performance, recording an operating margin of 9.5%.

Investors interested in exposure to Ralph Lauren can consider pooled investment vehicles like the iShares Morningstar Mid-Cap ETF (JKG), which invests 0.36% of its portfolio in the company.

Continue to the next part for a look at last year’s performance.