Analyzing ConocoPhillips’s Dividend and Dividend Yield

On July 11, ConocoPhillips (COP) announced a dividend of $0.285 per share on its common stock.

July 19 2018, Updated 7:30 a.m. ET

ConocoPhillips’s dividend announcement

On July 11, ConocoPhillips (COP) announced a dividend of $0.285 per share on its common stock. This dividend is expected to be payable on September 4 to stockholders of record at the close of business on July 23. This payment would apply to the third quarter.

ConocoPhillips’s last dividend payment and dividend yield

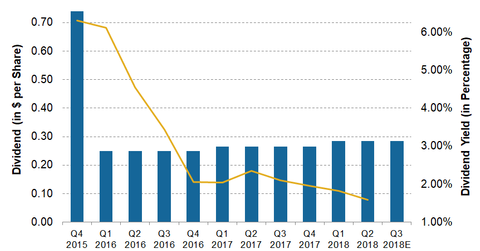

On June 1, COP paid its most recent dividend of $0.285 per share on its common stock. This was the dividend payment for the second quarter. COP increased its quarterly dividend on its common stock from $0.265 per share in the fourth quarter of 2017 to $0.285 per share in the second quarter.

For the trailing 12 months (or TTM), ConocoPhillips paid a total dividend of $1.10 per share on its common stock. On July 12, the company’s dividend yield—which measures the trailing-12-month dividend divided by its stock price—stood at 1.54%. On July 12, COP stock closed at $71.45.

ConocoPhillips’s dividend history

COP’s dividend payment has decreased from $0.74 per share in the fourth quarter of 2015 to $0.285 per share in the second quarter. As seen in the above chart, ConocoPhillips’s dividend had dropped steeply in the first quarter of 2016. In this quarter, COP reduced its dividend payment to mitigate its reduced operating cash flow due to declining crude oil and natural gas prices.

Dividend yields of other upstream players

On July 12, COP’s peers Occidental Petroleum (OXY), Marathon Oil (MRO), EOG Resources (EOG), and Devon Energy (DVN) had dividend yields of 3.69%, 0.93%, 0.60%, and 0.73%, respectively. Dividend yields measure the trailing-12-month dividend divided by its stock price. On July 12, OXY, MRO, EOG, and DVN closed at $84.56, $21.43, $124.14, and $43.93, respectively.

Next, we’ll look at Wall Street’s recommendations for COP stock.