What’s the Relationship between WNR, Crude Oil Prices, and SPY?

The correlation coefficient of Western Refining versus WTI and Brent stands at -0.53 and -0.64, respectively.

March 15 2016, Updated 9:09 p.m. ET

What is a correlation coefficient?

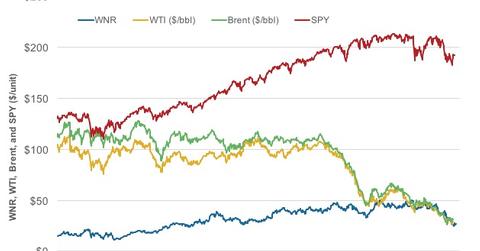

In this series, we have analyzed Western Refining’s (WNR) stock movements, business segments, leverage, cash flows, and valuations. In this concluding part, we will test the correlation between WNR’s stock performance, the broader market indicator, and crude oil prices.

A correlation coefficient shows the relationship between two variables. A correlation coefficient value of 0–1 shows a positive correlation, zero states no correlation, and -1–0 shows an inverse correlation. We have considered price history of WNR, the SPDR S&P 500 ETF (SPY), WTI, and Brent for the past five years.

Correlation analysis: WNR, crude oil prices, and SPY

The correlation coefficient of Western Refining versus WTI and Brent stands at -0.53 and -0.64, respectively. The correlation values for WNR and oil prices indicate that WNR’s stock price has an inverse relationship with oil prices.

In comparison with the broader market indicator, the SPDR S&P 500 ETF (SPY), WNR’s stock shows a strong positive correlation of 0.95. That means that around 95% of the movement in WNR’s stock price can be explained by movement in SPY. For exposure to mid-cap stocks, you can consider the iShares Core S&P Mid-Cap ETF (IJH). The ETF also has WNR in its portfolio.

WNR’s peer correlation analysis

WNR peer Valero Energy (VLO) shows a higher negative correlation to Brent. The correlation of VLO versus Brent stands at -0.73. Also, Marathon Petroleum (MPC) and Tesoro (TSO) show a strong negative correlation of -0.68 and -0.84 to Brent, respectively.

Integrated energy companies tend to have lower correlations to oil prices than do downstream companies. A case in point is Exxon Mobil (XOM), an integrated energy giant that has a 0.23 correlation with Brent.